Low Cost Investing Is a Thing, Passive Investing Is Not

.png) Someone has to choose what you own. Back in the day, it was your broker, calling during dinner, suggesting that you sell your Texaco and buy IBM instead. Later, you bought a mutual fund, which allowed you to save money on transaction costs, better diversify your portfolio, and limit your dinner time interruptions to political pollsters. Over the past few decades, indexed mutual funds and ETFs have made great strides in lowering investing costs by extraordinary amounts, but make no mistake, indexing is not passive.

Someone has to choose what you own. Back in the day, it was your broker, calling during dinner, suggesting that you sell your Texaco and buy IBM instead. Later, you bought a mutual fund, which allowed you to save money on transaction costs, better diversify your portfolio, and limit your dinner time interruptions to political pollsters. Over the past few decades, indexed mutual funds and ETFs have made great strides in lowering investing costs by extraordinary amounts, but make no mistake, indexing is not passive.We made this point last month about the S&P 500 index, which is certainly not a passively built index of the largest companies in the United States, despite common perception. Among other things, a committee of humans that work at Standard & Poor's decided that:

- 500 was the number of companies they wanted in that index.

- Is this a better number than the Dow 30 or the Russell 1000?

- Some companies make the cut, others don't.

- Verizon and AT&T aren't quite enough to represent the Telecommunications industry, in their opinion, so there should be a third company added, but T-Mobile (a $59B company) and Sprint ($27B) would add too much? CenturyLink ($23B) is just right.

- Tesla has suffered a similar fate, a company worth over $40 billion dollars (on October 8th, at least). It's not included in the S&P 500, but Harley-Davidson ($8B) is?

- Meanwhile, in the world of corporate governance, companies that issue multiple shares of stock (e.g. Google & Berkshire Hathaway) were allowed, but then they changed their mind (sorry Snap).

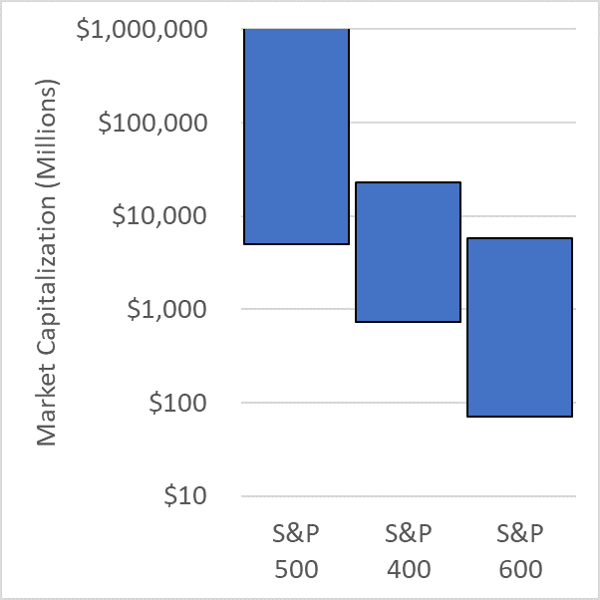

The folks at S&P also have sibling indices for small (S&P SmallCap 600) and middle (S&P MidCap 400) sized companies. Put them all together, and you get the S&P 1500. In my opinion, the smallest "large" company should be about the same size as the largest "mid" company, and so forth. S&P disagrees, they seem to think the smallest "large" company should be about the same size as the largest "small" company, and "middle" companies would overlap the other two, as shown here:

Active decisions in index construction are not exclusive to S&P and market capitalization. The other indexing companies have their own set of decisions that can be criticized by the peanut gallery. The NASDAQ composite is directly related to the companies listed on that exchange, which traditionally have been technology companies, but those waters are muddied already and will get worse. The fixed income index providers have to build their indices based on what debt is available in the market. It doesn't matter how much they might want high quality 30-year US corporate credit in their index, if Microsoft and Johnson & Johnson aren't issuing it, they don't get it!

The active nature of the index was especially in the spotlight this year when another conference room in the ivory tower was bustling with sector classification changes. The high level change to put media and communications companies together does make some sense, but it is certainly an active decision. Tell me, if you were kicking a bunch of companies out of the Information Technology sector over time, and you decided Amazon, eBay, and Grubhub are now Consumer Discretionary companies, where would you put Cars.com and Zillow?

If you answered Communication Services, there might be a job for you at GICS.

Teasing aside, the folks making these decisions are doing good work overall. Indices provide systematic methodologies that allow for the creation of investment products that are more efficient and less expensive than they were in the past. The investing public's drive to put more assets into cheaper products that track indices is fine; we do it here for our clients every day. ETFs can help solve real problems in portfolios, even those accounts owned by people that prefer mostly individual securities.

Remember, though, that the reason for doing this is cost, not an elimination of human involvement in your portfolio. As much as it might feel that buying an index is removing the human element, you are not; you are only removing their identity. If you would like to know the humans managing your money, schedule some time with one of ours.

Andrew Stewart, CFA is a Senior Portfolio Manager at Exchange Capital Management, a fee-only, fiduciary financial planning firm. The opinions expressed in this article are his own.

Comments

Market Knowledge

Read the Blog

Gather insight from some of the industry's top thought leaders on Exchange Capital's team.

Exchange Capital Management, Inc.

110 Miller Ave. First Floor

Ann Arbor, MI 48104

(734) 761-6500

info@exchangecapital.com