Shuffling the Sector Deck

%20-%20Playing%20Cards%20with%20Company%20Logos%20-%20JPEG%20-%202-28-2020.jpg?width=945&name=Image%20-%20Blog%20Image%20-%20Andy%20-%20Shuffling%20the%20Sector%20Deck%20(updated)%20-%20Playing%20Cards%20with%20Company%20Logos%20-%20JPEG%20-%202-28-2020.jpg) Have you heard about the ivory tower academics who unilaterally made a huge decision affecting billions of dollars last year? To make matters worse, if investors fall into the trap of trading like automatons, this will trigger untold millions in taxable gains in the process!!! I presume you hadn't heard about this investment earthquake, but I bet I have your attention now.

Have you heard about the ivory tower academics who unilaterally made a huge decision affecting billions of dollars last year? To make matters worse, if investors fall into the trap of trading like automatons, this will trigger untold millions in taxable gains in the process!!! I presume you hadn't heard about this investment earthquake, but I bet I have your attention now.

We've talked before about how index-based investing isn't as simple and passive as people often assume. For example, Tesla is one of the five hundred largest companies in the United States, but it is not a part of the S&P 500 Index, because Standard & Poor's hasn't made the decision to add it yet. Another case: in the world of small capitalization stocks, there is an institutional debate between FTSE Russell and Standard & Poor's, who own the two most widely used indices in that asset class. So, while discussion regarding active versus passive investing may never end, I would argue most of the options out there for "passive investing" aren't even actually passive. Now, doomsday predictions and name-calling aside, 2018 has brought a potentially damaging episode of the unintended effects of index construction and maintenance.

The Big News

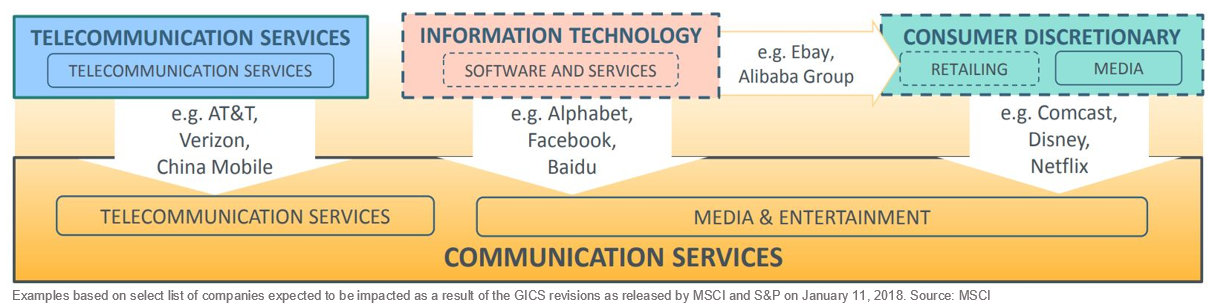

In November there was an announcement by Standard & Poor's and MSCI, who together manage the definitions of the Global Industry Classification Standard (GICS), that they are moving companies around between the Information Technology, Consumer Discretionary, and Communications sectors. More recently, they gave us some more information about their plans. The exact timing is unknown, but expected later this year, GICS will be moving companies currently located in the Information Technology (e.g. Google, Facebook) and Consumer Discretionary (e.g. Disney, Comcast) sectors into Communications alongside AT&T and Verizon.

This change is reasonable from an academic perspective.

Comcast, for example, is more like Verizon than it is like Home Depot, and it sounds like Netflix will welcome the change. Furthermore, for many participants in the market, this may sound like a non-issue. The manager of a diversified equity portfolio that owns individual stocks simply moves Google stock out of their IT bucket and puts it in their Communications bucket. No actual transaction needs to occur in those accounts, but they still need to be worried.

A Problem for the Market

The problem is the array of investment products that are linked to these sectors and now need to rejigger to account for the change. There are billions of dollars invested in ETFs and mutual funds that passively track sector indices, which could be changing in lockstep with the GICS changes. Here's why this is a big deal: if executed without thought, the Information Technology funds will attempt to sell a lot of Google and Facebook and buy a bunch of Microsoft and Oracle in one day. Similar machinations would occur in the Consumer Discretionary and Communications funds. Meanwhile, what if the end investors in these funds also mechanically sell down their holdings in the IT and Consumer Discretionary funds and buy up their holdings in Communications? That's a lot of money moving around, enough to move markets, especially if attempted in a very short time period. This might be the Y2K prediction of 2018, but we dodged Y2k because smart people did a lot of planning and work, not because the original predictions were incorrect.

Hold on, it gets worse for taxable investors.

If funds sell their Google and Netflix holdings at a profit, they have to pass on the capital gain to their shareholders. People often think ETFs are immune to this, but if the sale happens inside the fund, the taxes are incurred. There are ways to avoid this as an ETF, but it requires thoughtful and active decision making on the part of the ETF portfolio managers. Beyond that, when a holder of an ETF sells it at a profit, this also generates taxable gains.

So, what can the industry do to dodge this catastrophe?

We have been speaking with the index makers and sponsors of the sector ETFs we know regarding how they plan to manage the transition. This isn't a one size fits all situation, and so far, the plans that have been articulated make sense to us, given the various circumstances of the funds. The final decisions haven't been made in GICS, though, so nothing is set in stone and further diligence is required in the coming months. Market participants asking intelligent questions is an important part of maintaining an efficient market, so I hope these conversations broaden and become more public as the year goes on.

For the holders of the ETFs themselves, if you are overly tax sensitive, you will fail to rebalance your account as the sectors change and end up holding too much implicit Apple and Amazon, and not enough Google and Disney. You shouldn't let taxes dominate your decision making, so trimming allocations to the Information Technology and Consumer Discretionary ETFs and buying more Communications makes sense. Yes, this will lead to some capital gains, but if you trade in a tax optimized manner, this can be potentially mitigated.

The short story

This change will result in more taxes being owed in 2018 than there would have been otherwise. Intelligent execution by all the involved players can minimize the damage, but the tax ramifications will be non-zero, barring a large decline in the prices of stocks in the Information Technology and Consumer Discretionary sectors (be careful what you wish for).

What can you do?

First, do some research and analysis. Do you own any of the affected funds? Are they being managed by portfolio managers you believe to be smart and attentive? Or perhaps they were picked for you by an investment advisor; do you believe them to be good at investment manager due diligence? You need to develop a level of comfort that the fund managers are working to avoid huge capital gain distributions later this year.

Next, assuming zero gains are distributed from your funds, what would be the tax effects of rebalancing your portfolio in one blow later this year? What would be the portfolio risks if you did nothing? In the world of capital gains, the only way to avoid taxes is via market decline or death, so you should hope that the taxes are coming sooner or later. Nonetheless, taxes paid later is usually better than sooner, so this deserves some thought.

Your Sector Shuffle Cheat Sheet:

- Know what you own

- Know your investment team is paying attention

- Tolerate some taxes to achieve proper portfolio diversification

- Brainstorm Y2K style jokes for next year when this is all managed well and becomes a non-issue

Andrew Stewart, CFA is a Senior Portfolio Manager at Exchange Capital Management, a fee-only, fiduciary financial planning firm. The opinions expressed in this article are his own.

Update September 2018: Andrew Stewart, CFA recently appeared on an episode of Behind The Markets hosted by Jeremy D. Schwartz and powered by Wharton Business Radio and Jeremy Siegel. In this episode, Andy discusses the upcoming sector reclassifications and how these changes can impact the individual investor. listen to the full podcast above or skip ahead to 30:44 to learn more about the shuffling sector deck.

Comments

Market Knowledge

Read the Blog

Gather insight from some of the industry's top thought leaders on Exchange Capital's team.

Exchange Capital Management, Inc.

110 Miller Ave. First Floor

Ann Arbor, MI 48104

(734) 761-6500

info@exchangecapital.com