%20-%208-29-2022.png?width=1600&name=Image%20-%20Blog%20Image%20-%20EE%20-%20What%20Are%20Exchanges%20All%20In%20Costs%20-%20Money%20Count%20(Color)%20-%208-29-2022.png) When deciding to entrust your financial well-being in the hands of another, pricing and costs are probably one of the first areas where you’ll have questions. At Exchange, we believe in being transparent in all our work, but especially when it comes to our cost of service. We never want to hide this information behind a “request a quote” form.

When deciding to entrust your financial well-being in the hands of another, pricing and costs are probably one of the first areas where you’ll have questions. At Exchange, we believe in being transparent in all our work, but especially when it comes to our cost of service. We never want to hide this information behind a “request a quote” form.

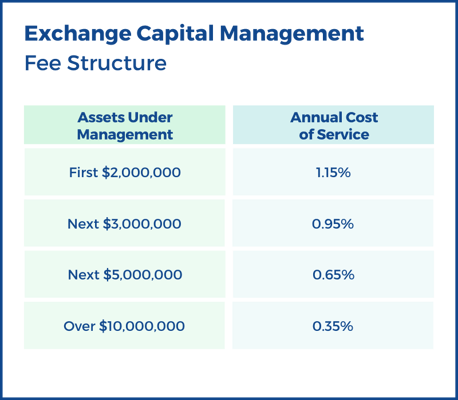

Our cost of service is built on an Assets Under Management (AUM) model. This means we deduct a management fee based on the level of assets entrusted to our care.

What Is a Management Fee?

Our management fee is billed as a percentage of the assets we manage. This percentage is tiered and based on the chart below.

Does Exchange Have Any Hidden Fees?

While our management fee is the only fee that we will bill you for, some investments do come with additional costs you’ll want to be aware of.

Our portfolios are primarily designed with individual stocks and bonds. Apart from the purchasing price, there are no additional costs to owning these securities. We also supplement individual securities with Exchange Traded Funds (ETFs), and sometimes traditional mutual funds, to aid in diversification. While external funds carry additional costs known as expense ratios, we use them in portfolios when they bring value that is worth that cost. We do extensive due diligence when selecting external managers of our clients' assets, and the expense of the funds is an important part of the selection process.

Additionally, while trading and transaction costs don’t typically apply to individual securities, they can apply to some bonds and funds. Depending on the investment, you might be charged anywhere from $10 to $30 per transaction.

We strive to choose low-cost investments. We never want to generate extra costs in your portfolio. The only fee Exchange will bill on is the management fee alone. Any additional transaction or fund fees outlined above go directly to your custodian or the funds themselves, never back to Exchange.

Do Exchange’s Fees Change with the Market?

It is important to realize that even if our fee structure remains the same, market fluctuations, withdrawals, and asset transfers can change the level of assets in our care. As your portfolio increases and decreases, the amount we bill will also change but the percentage will remain constant.

What Does It Cost to Close My Account with You?

Closing an account with us doesn’t cost anything. We bill you quarterly and in advance. If you decide mid-quarter to transfer your assets away from our care, we will refund you for the work we’ve yet to complete. We do however require a 30-day notice. We firmly believe that avoiding archaic and restricting contracts, allows us to build stronger relationships with our clients.

The Bottom Line

While considering hiring a financial advisor, pricing and costs will always be top of mind. As with all elements of business, we want to maintain a high level of trust, honesty, and transparency in our pricing.

At the end of the day, we do not charge a flat fee and our tiered fee structure can lead to some confusion. Consider scheduling a meeting with us to get a firm grasp of your individual fee schedule. We are always happy to sit down with you and answer any questions you may have.