Keep Calm and Stay Invested

%20-%20PNG%20-%2007-20-2021.png?width=1600&name=Image%20-%20Blog%20Image%20-%20Matt%20-%20Keep%20Calm%20and%20Stay%20Invested%20-%20TeenBanking%20(Color)%20-%20PNG%20-%2007-20-2021.png) One of my favorite sayings is, “Champions aren’t born in the ring, they are merely recognized there.” In other words, you can’t just show up one day and decide that you are going to win the game, or pass the test, or become wealthy. It takes time, patience, and discipline. Sometimes it takes overcoming and adapting. Above all else, it takes staying the course through both the good days and bad, through the successes and setbacks.

One of my favorite sayings is, “Champions aren’t born in the ring, they are merely recognized there.” In other words, you can’t just show up one day and decide that you are going to win the game, or pass the test, or become wealthy. It takes time, patience, and discipline. Sometimes it takes overcoming and adapting. Above all else, it takes staying the course through both the good days and bad, through the successes and setbacks.

Instant Gratification or Sustained Wealth?

I bet that we can all point to that person we know who got in on GameStop before it popped, or who bought a little bitcoin years ago before it became “worth” a bajillion dollars. However, the reality is that those stories are few and far between, and are akin to winning the lottery. Nothing against the lottery, I bet it feels amazing when you find out you became an instant multimillionaire, but it’s probably not the best strategy to stake your retirement on.

Instead, most financially secure people acquired their wealth over time with hard work, patience, and discipline. In other words, they are wealthy today because they stayed the course. They didn’t panic when the Dotcom bubble burst or when the Great Recession hit. Instead, they reminded themselves that they were going to retire umpteen years from now and if they remained disciplined, they would recoup those losses and still thrive during retirement.

We received yet another prescient reminder over the last year how invaluable this is when investing for your retirement. Most people remember the incredible bull market we experienced over the past decade and how easy it is to stay calm and disciplined when times are good. However, 2020 reminded us that its hard, but even more important, to exhibit those same traits when the proverbial excrement hits the bought air machine. To illustrate this let’s look at some numbers, dates, and charts.

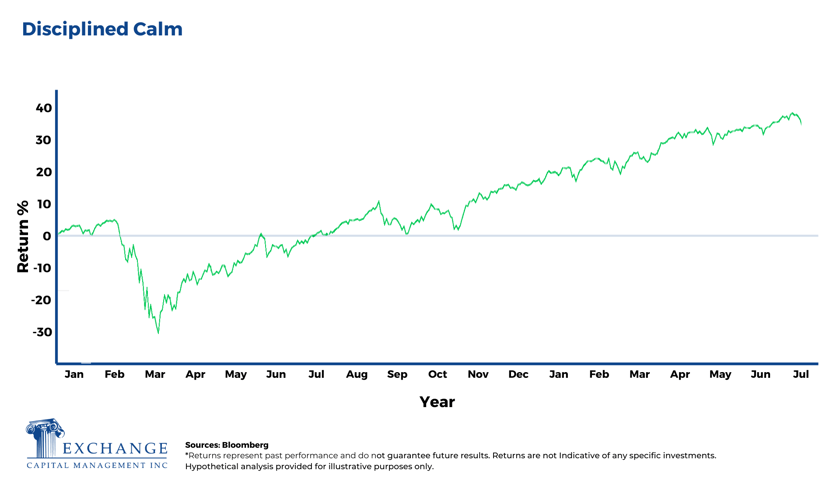

Stay In the Fight

2020 started like any other normal year, the market went up, it went down, and it even went sideways. Then Covid hit and pandemonium followed. Over 23 trading days during February and March, the market dropped approximately 35%. During this time many people panicked, pulled out of the market, and kept their assets in cash. Let’s start by looking at what would have happened if instead of panicking, you stayed in the fight and rode it out. If you started 2020 with $1,000,000, today you would have approximately $1,350,000 -- a hefty 35% return. This is illustrated by the chart below.

Leave the Ring

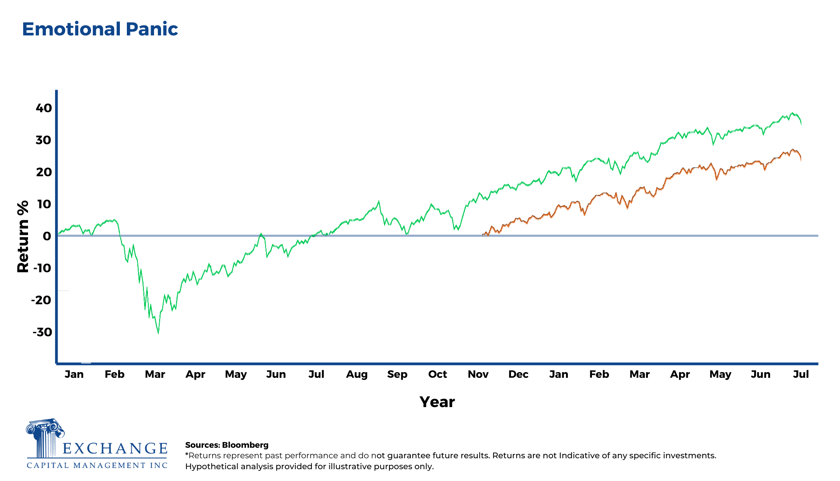

Now let’s look at how things would have gone if you let emotion and panic take over. To be generous we won’t cherry pick the absolute bottom, but let’s say by March 1 you saw the writing on the wall with the relatively sizeable drop the week prior and decided it was time to get out. Lucky for you, you avoided the steepest part of the drop and avoided losing 30% of your assets. While that is great, now comes the tougher part, do you reinvest that cash and if so, WHEN? Is this the bottom, or is it a false bottom and something worse is coming? You have already let panic take over; how do you know when to tell it to go away? If you started 2020 with that same $1,000,000, went to cash when you had $917,300 and still have it in cash you would have roughly that same amount, not even getting close to the $1,000,000 you started 2020 with.

For arguments sake you did finally decide to get back into the market. Also, let’s say that decision was made the day Pfizer announced it had a vaccine and people finally believed there was an end in sight. On November 9, 2020, you invested that $917,300 into the broad market and have received a 24.6% return to date leaving you with $1,115,000. You lost out on $235,000 by letting emotion cloud your decision making.

Disciplined Calm > Informed Adaptation > Emotional Panic

Now, let’s look at a third option. Instead of just staying the course, and instead of panicking and going to cash, what would it look like if you had made an informed decision and decided to de-risk some and change your asset allocation from 100% equity to something resembling a 70/30 stock to bond mix? You made the change on March 1 when, as illustrated above, you had $917,300. Of that, 70% or $642,000 stayed in stocks and returned a nice 47% leaving you with approximately $945,000 today. That leaves 30%, or $275,000 in bonds and returning 3.1% leaving you with $284,000 today. Add those two together and you returned $1,129,000 – still ahead of the leave the ring scenario.

Sure, it’s less than if you just stayed in stocks but perhaps your piece of mind over those months was more than worth it to you. The point of this illustration is that in order to achieve financial freedom, just like being a champion, takes staying the course through the good times as well as the bad. Or, if you can’t stomach that, try to find a way to adapt and get through instead of just giving up all together.

Remove the Emotion, Add an Adviser

This is why it is so important to hire a sound financial adviser that acts in your best interest. They can help reassure you during the tough times by revisiting your financial plan and showing you that despite a 20% or even 30% market correction, you and your loved ones will be okay. Reminding you that your life savings won’t disappear.

If we are being our best selves, we know that purely emotional decisions don’t usually lead to great results. Instead of running the risk of making those emotional decisions that could cost you your chance at reaching your financial goals, call Exchange Capital. Go spend time with your loved ones, go fishing, take that trip, but most of all turn off the perpetual doomsday machine that is the news and let us take on the burden of ensuring you stay the course and reach your goals.

Matt Farris, is a Portfolio Manager at Exchange Capital Management. The opinions expressed in this article are his own.

Comments

Market Knowledge

Read the Blog

Gather insight from some of the industry's top thought leaders on Exchange Capital's team.

Exchange Capital Management, Inc.

110 Miller Ave. First Floor

Ann Arbor, MI 48104

(734) 761-6500

info@exchangecapital.com