How to Earn Portfolio Income in a Low Interest Rate Environment

Interest rates are low. For a borrower, this is a good thing. If your credit is in good shape, you can probably refinance your mortgage at less than 4% and buy a new car with financing under 1%. For a saver, especially a retired one attempting to live off the income generated by a portfolio, this interest rate environment may feel troubling.

Interest rates are low. For a borrower, this is a good thing. If your credit is in good shape, you can probably refinance your mortgage at less than 4% and buy a new car with financing under 1%. For a saver, especially a retired one attempting to live off the income generated by a portfolio, this interest rate environment may feel troubling.

What is a Retiree to Do?

You watched your parents buy treasury bonds in retirement in the 1970s through 1990s that paid a 5% coupon or more, which was enough income to supplement their social security and pension. Plus, they usually bought those bonds at prices below their final maturity value (also known as par value or face value), so their portfolio would grow a little as the bonds matured, even as they were taking all the income out. These days, to buy a 10-year treasury that pays a measly 3% coupon, you have to pay well over $110 for a $100 face value bond!

Meanwhile, in stock land, good companies used to pay and grow dividends as they became more profitable. Now, Amazon makes tons of money, pays no taxes, and doesn't pay a dividend! Even the companies that do pay dividends are doing stock buybacks, so they aren't paying as much income to your portfolio as they could be. What ever happened to shareholder rights!?

What Not to Do: Chase Yield

Solving this problem starts with some changes in how you think about your portfolio. Before we discuss that however, let's start with what you shouldn't do: buy assets on yield alone. You can find plenty of ads, blogs, newsletters, and brokers who will happily talk up the hidden gems they have with yield in these tough times, but if it sounds too good to be true...well, you know how that goes. The bond market isn't a global scavenger hunt, where some people manage to find high yielding AAA bonds while the rest of us are stuck with our measly treasuries.

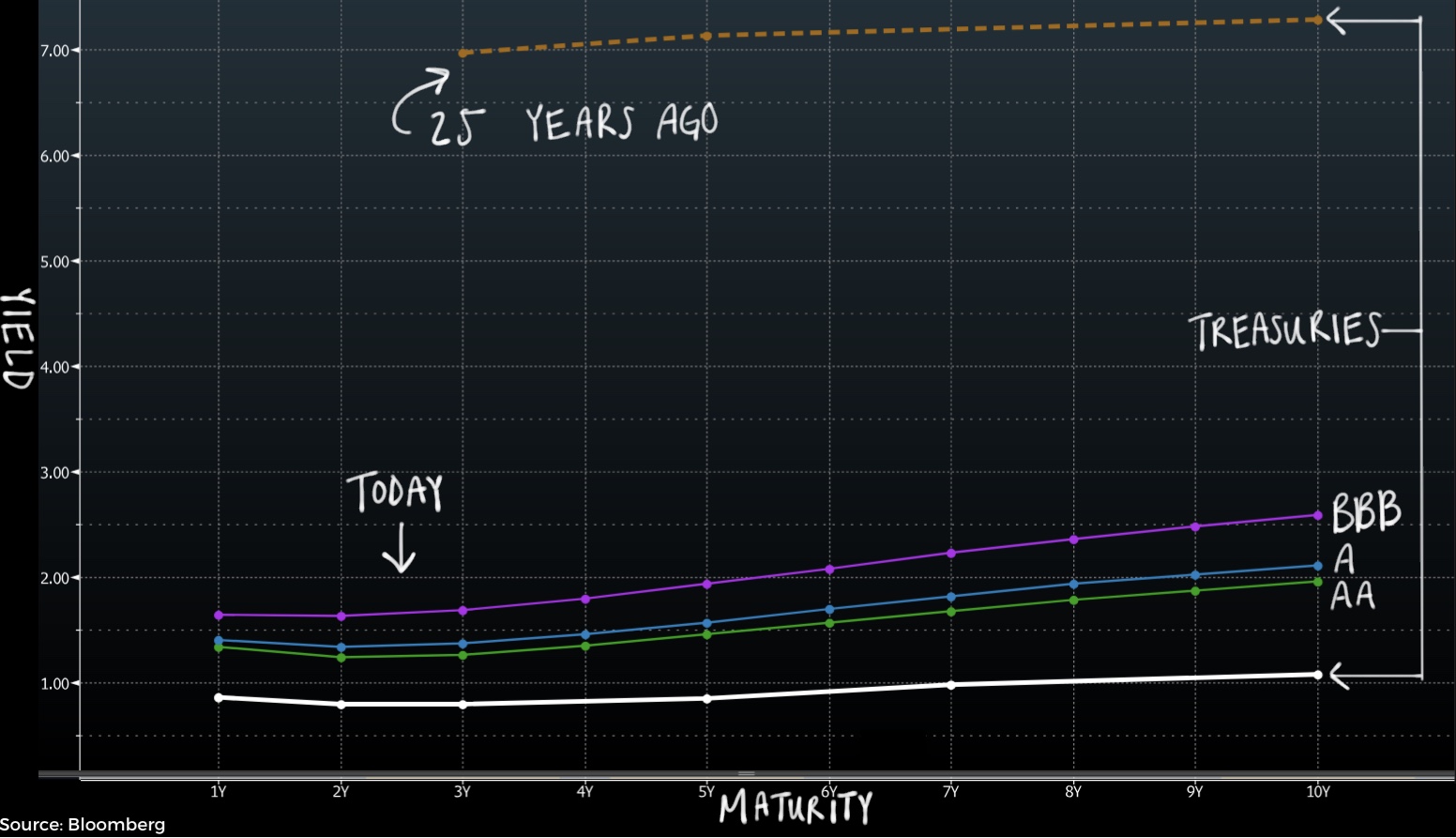

Everyone wants safe yield: you, your neighbor, your college's endowment fund, your city's police and fire pension fund, a Polish life insurance company, everyone. The bond market is global. Given all that demand for bonds, the prices are high, which means the yields are low. You get some extra yield for taking credit and liquidity risk, and only a little extra yield for taking duration risk. All these yields pale in comparison to the yields your parents got on treasuries back in the day.

The only way to earn something notably above these numbers is buying a non-investment grade bond or buying something that isn't really a bond (and has other risks involved). This is a tough situation, and there is no perfect solution. Here is a bad solution: blindly reach for yield and take ignorant risks not appropriate for the ballast of your portfolio. So, given that your parents' perfect portfolio isn't available, what else is there?

First: Adjust Your Expectations of Your Portfolio

For years, savers and retirees have expected their portfolio to provide income via coupons and dividends paid out by bonds and stocks. I propose that we pivot to a framework where we expect a portfolio to provide cash flow to meet current and future expenses and goals. A retiree that owns Amazon stock can sell a little of it every month to pay their expenses just as easily as their neighbor who owns a bond can use the coupon to pay the same bills. In fact, because of how these different assets are taxed, the Amazon retiree might pay less in taxes too.

With this paradigm shift, your portfolio can focus on owning the right mix of assets that aligns with the goals of your financial plan, rather than focusing on buying only the securities that return cash to investors via a particular process.

Second: Remember Who Your Portfolio Is For

The IRA that you have amassed over your career is not a pension fund that needs to survive forever. It is a retirement account that needs to fund your retirement. You sacrificed every working year to contribute to your retirement accounts, and now you get to live off them. A strong financial plan ends with you achieving all your lifetime goals with at least a dollar in the bank in the end, not with your portfolio at the exact same balance as it was on your 65th birthday. Sure, leaving something extra for your kids or charity is nice, but it isn't necessarily a requirement. If you need to sell a small amount of your portfolio each year to fund your retirement and execute on your plan, there isn't some golden rule against it.

Andrew Stewart, CFA, CAIA is Chief Investment Officer at Exchange Capital Management, a fee-only, fiduciary financial planning firm. The opinions expressed in this article are his own.

Comments

Market Knowledge

Read the Blog

Gather insight from some of the industry's top thought leaders on Exchange Capital's team.

Exchange Capital Management, Inc.

110 Miller Ave. First Floor

Ann Arbor, MI 48104

(734) 761-6500

info@exchangecapital.com