Hope: Infectious, Inspiring, Necessary.

This blog post is going to be different than my prior posts because the circumstances are different. It is more personal because it is written from my home, at night, while my wife and two young children are safely asleep. It may stray a bit from my oft-cited financial planning tenants because right now it is impossible to look at anything in a vacuum. But despite the blur of uncertainty, I’d like to write about hope.

This blog post is going to be different than my prior posts because the circumstances are different. It is more personal because it is written from my home, at night, while my wife and two young children are safely asleep. It may stray a bit from my oft-cited financial planning tenants because right now it is impossible to look at anything in a vacuum. But despite the blur of uncertainty, I’d like to write about hope.

All too often, the phrase "hope is not a plan" is dismissively used to end essential conversations. But I see it differently. Hope isn't what we do when we're out of options. Rather, hope, when tied to a well-designed strategic plan, is infectious. It's a call-to-action that inspires others, builds trust, and becomes our super-power as we seek solutions to big problems.

Intentional Damage

As we watch the horror show of economic data from around the world, it’s important to remember that there’s a purpose behind this damage. As Andy Stewart, our Chief Investment Strategist, suggested in his radio interview, the economic damage is not a direct result of the virus itself. Rather it is primarily a result of the actions taken to mitigate the human health toll of the virus. In essence, we are starving the economy in an effort to starve the virus.

Lessons Learned

Although not a virologist, I do have chops in the area of investing. Having experienced my fair share of economic cycles over my 30-year career, I have learned three critical lessons. First, each cycle is unique – in triggers, vulnerabilities and outcomes. After each cycle, we work to strengthen weaknesses and install a framework to mitigate the risk of re-occurrence.

The second lesson is that our $20 trillion U.S. economy is diversified, flexible and resilient. If we pause for a moment and create a bit of distance between our nose and our iPhone, we’re able to see that we do recover; and we find normal again, albeit a different normal. Events like the OPEC oil embargo of the 1970s, 9/11, and the Great Financial Crisis of 2007-08 have a permanent imprint on our culture. But our economy does heal from downturns and eventually comes out strong on the other side.

The third lesson is that while in the heart of a crisis – either financial or economic – we get scared. Today, possibly more so than in the past, because the real problem is a health crisis, not a downturn triggered by economic or financial excesses. As a result, it seems probable that our next “new normal” will look different from the last. And like our own immune system, the U.S. economy will have new antibodies, making it more resilient than before.

Stock Market Resilience

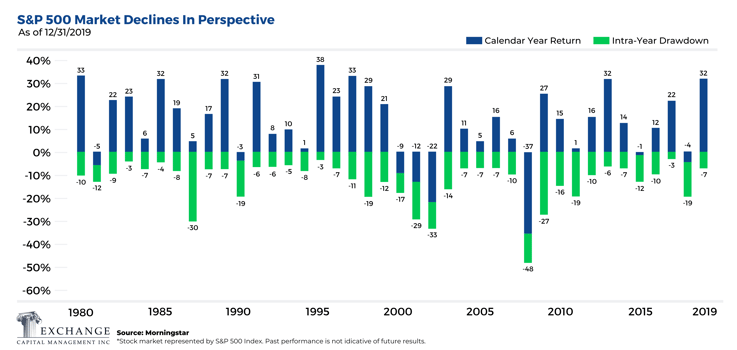

Stocks are the best way to build wealth over one’s lifetime, but there is a very real price to pay for that wealth creation. That price is discomfort, anxiety, and pain. The chart below is a good way to visualize this pain. It shows the maximum high point to the minimum low point (Intra-Year Drawdown) for every calendar year back to 1980, as well as the ending, full year rate-of-return (Calendar Year Returns). The average intra-year drawdown on a calendar basis is -12.5%. The lesson? Some years are mildly uncomfortable while others quite painful, but every year, without fail, there is a price that must be paid.

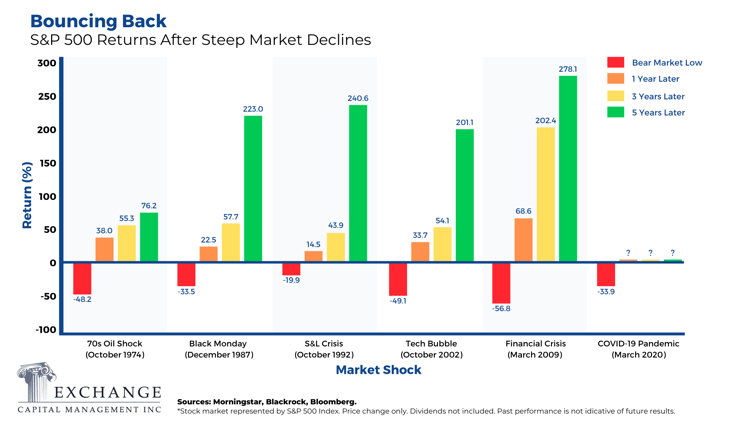

Unfortunately, we can never predict when these episodes will flare up, or when they will end. But eventually they end, typically ushering in a beginning that is highly likely to provide an out-sized reward. The most recent example of this pattern is displayed below. In March 2009, the stock market bottomed after a peak-to-trough decline of 57%. From there, it began a remarkable ascent, advancing 68% after one year, 202% after three years and 278% after five years.

Of course, the adage “must be present to win” is indisputably true. And this ‘presence’ is exactly why investors who can endure pain usually get paid handsomely over the long run. Easy to say, hard to do, but the data backs it up.

Investors who are considering moving entirely out of stocks during bear market declines should carefully reconsider such action and, even better, engage the support, insight and discipline of an independent financial advisor. In fact, I would submit that the value proposition offered by an experienced, trained investment professional is at its highest during moments like today.

Hero Redefined

During a crisis, heroes come to the forefront because many of our basic human needs are threatened, including our need for certainty, safety and purpose. But the beauty of this moment is that we don’t have to look far to spot our heroes. We are surrounded by ordinary people who are giving of themselves to serve others. Think of the bus drivers, delivery people, grocery store clerks, post office workers, police officers, social workers, janitorial staff, teachers, child-care providers, farmers, the men and women of our military and, of course, our front-line doctors, nurses and health care providers. Their dedication deserves our thanks. It also proves that the great strength of America remains where it has always been: in ordinary citizens setting their shoulders to accomplish the task before them.

Dawn after Darkness

It’s daybreak and my children will wake soon. As the early light of today emerges, I remain struck by the great uncertainty with which we are facing the day. But I’m also reminded that calamity reveals who we truly are, and that, in our past we have weathered great crises. Moreover, those crises have unearthed previously un-imagined strength and a greatness that reflects the principles of human ingenuity, self-determination and sacrifice.

Hope

I hear footsteps. Hopeful sounds. The epidemiologists of the future are awake.

Gotta go hug my kids.

Kevin McVeigh, CFA is a Managing Director and Partner at Exchange Capital Management, a fee-only, fiduciary financial planning firm. The opinions expressed in this article are his own.

Comments

Market Knowledge

Read the Blog

Gather insight from some of the industry's top thought leaders on Exchange Capital's team.

Exchange Capital Management, Inc.

110 Miller Ave. First Floor

Ann Arbor, MI 48104

(734) 761-6500

info@exchangecapital.com