Share this

Will I Be Taxed When Gifting Money?

by Exchange Capital Management

%20-%2012-14-2023.png?width=1600&height=900&name=Image%20-%20Blog%20Image%20-%20Will%20I%20Be%20Taxed%20When%20Gifting%20Money%20-%20Handoff%20(Color)%20-%2012-14-2023.png)

If you’re planning on gifting assets to your loved ones, whether it be money, stocks, a car, or other items, here’s some good news: it’s often a simple and tax-free process. However, like most things, it comes with exceptions. There's a cap on how much you can gift without informing Uncle Sam. Let's simplify the basics of gift tax – what you can give without worrying about taxes and when you might need to think about them.

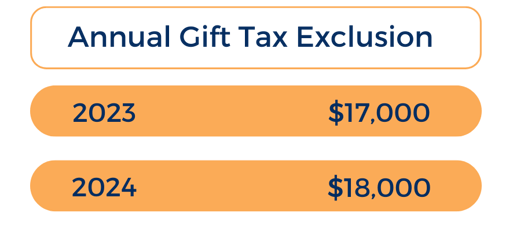

Understanding the Annual Gift Tax Exclusion

Here’s how much you can give (excluding gifts made to a qualified charity) in the upcoming years without incurring extra tax work:

This limit is how much you can give per person. For instance, if you’re feeling generous in 2024 and gift $18,000 to a family member and friend, you don’t need to tell a soul. However, if you gift $20,000 to someone – you must inform the IRS about the excess ($2,000). Now, if you're married, here's a perk: you and your spouse can team up and gift double the amount, making it a joint limit of $36,000 per person. So, if you're looking to give a gift to your child and their spouse, you can collectively go up to $72,000 ($36,000 to your child and $36,000 to their spouse).

If you or your spouse gift more than the allocated amount, you’ll need to let the IRS know. This involves filing a gift tax return, specifically using IRS Form 709. Remember, gifts extend beyond cash – whether it's a car or appreciated stock, any excess must be reported.

Timing can be used to your benefit since the gift clock resets on January 1st. For example, you can gift $17,000 in December of 2023 and another $18,000 in January 2024 without raising any alarms since you’re still under the annual limit. Even better, if you and your spouse want to gift as much as possible to another couple in a short amount of time, you can do $68,000 by the end of 2023 and another $72,000 that January, totaling $140,000 from one household to another within a few days without having to file a gift tax return.

Even if you go over the limit, there’s no need to panic about taxes quite yet; the IRS just wants to keep an eye on your gifting to make sure it stays within the lifetime limit – a threshold that most people won't reach but should be mindful of.

What’s The Lifetime Gift Tax Exclusion?

The lifetime limit is not how much you can give in your entire life, but rather how much you can gift over the annual limit (or pass through your estate) without paying taxes:

.png?width=557&height=371&name=Annual%20Gift%20Tax%20Exclusion%20(8).png)

Let’s break down how the annual and lifetime gift limits work together in a real-life scenario. Imagine you decide to gift your child $4,000,000 in 2024. This surpasses the annual limit by $3,982,000. Since it exceeds the limit, you're required to inform the IRS. The IRS, in response, deducts the $3,982,000 excess from your lifetime gift tax exclusion. This means your remaining lifetime gift exclusion is now $9,628,000.

No taxes will be due unless your lifetime exclusion is lower than the value of your estate upon your passing. Following our previous example, if your remaining lifetime exclusion is $9,628,000 and you pass away with a $10 million estate, taxes would be owed on the remaining $372,000.

If you have a large estate or plan to be generous with gifts over your lifetime, there are some strategies to coordinate giving to your family while minimizing exposure to future estate taxes. These strategies often center around spreading out your gifts over time.

If you anticipate that the gift and estate tax will apply to you, either soon or in the future, the tax rate ranges from 18% to 40%, depending on how much you go beyond the limit. If this is something you're considering, take a look at this tax bracket.

The Bottom Line

The lifetime gift limit is currently quite favorable, allowing many people to share their wealth without worrying about the impact of taxes. If you want to write a check to your loved ones, remember to stay mindful of the rules, be prepared to file a gift tax return if necessary, and keep track of any changes in the law.