Share this

When Should I Claim My Social Security Benefits?

by Exchange Capital Management

%20-%2012-16-2022.png?width=1600&height=900&name=Image%20-%20Blog%20Image%20-%20WSA%20-%20When%20Should%20I%20Claim%20My%20Social%20Security%20Benefits%20-%20Fence%20(Color)%20-%2012-16-2022.png)

Are you leaving money on the table? You’ve been contributing to Social Security for years, but when do you get to reap the benefits? Those who qualify can start collecting Social Security as early as age 62 and as late as age 70. While you can claim at age 62, many should consider waiting until their Full Retirement Age (FRA) or after.

What Is My Full Retirement Age (FRA)?

Your FRA is when you’re eligible to receive full Social Security benefits. However, there isn’t a set FRA for everybody. Due to changes in life expectancy, your FRA depends on when you were born.

.png?width=1000&height=500&name=Full%20Retirement%20Age%20(1).png)

What Happens If I Collect Before My FRA?

For those who choose to collect as early as possible, your benefits will be reduced for each month you claim Social Security prior to FRA. If you claim benefits when you are 62 years old, you can face a 30% reduction in your monthly benefits. This reduction is permanent.

What Happens If I Delay Past My FRA?

The longer you delay Social Security, the greater the monthly benefits you receive. However, delaying is not irreversible. You can initially choose to delay past your FRA, but then decide waiting until 70 isn’t realistic. When you choose to start collecting your benefits is completely up to you.

Every month you delay after reaching FRA, your benefits are increased by .66% (8% annually). The monthly increase will stop once you reach age 70. If you wait until you are 70 years old, you will receive monthly benefits that are around 32% higher than your full benefit amount. While delaying your benefits will give you a higher monthly payment, waiting may not be feasible or prudent for everyone.

What Should I Consider Before Claiming Social Security?

Life Expectancy

Life expectancy plays a role in maximizing your social security benefits. Those who expect to have a shorter life expectancy whether it be from underlying conditions, diseases, or genetics may benefit from claiming their benefits earlier. Based solely on life expectancy, here’s when it makes sense to claim:

- If you expect to live into your early 70s, you should claim at age 62

- If you expect to live into your late 70s, you should claim at your FRA

- If expect to live into your mid-80s, you should delay until age 70

If you don’t have any underlying conditions that may impact your life expectancy, we often advise that you wait until either your FRA or age 70 to maximize benefits.

Financial Considerations

Can you afford to wait? It is easy to get caught up in government incentives, but the fact is not everyone can afford to wait. Here are some questions to ask yourself before collecting Social Security:

- Do I need the income?

- Do I fully understand where I fall in terms of taxes?

- Will collecting Social Security impact other financial strategies?

If you have other income to draw from, you should consider delaying your Social Security benefits. Once you start collecting, it’s hard to stop. Social Security is guaranteed income. If you pair it with additional income, you may be getting taxed for income you don’t technically need.

Behavioral Considerations

If you’re searching for Social Security answers online, you’ll probably come across several articles talking about its impending doom. There is a narrative that Social Security funding is running out and that some of us will not receive benefits in the future. While misleading, it often trickles into our mentality when making financial decisions.

While we can talk about the penalties of claiming early and the benefits of waiting, managing your emotions is important. If the consequences don’t outweigh your concern, do what makes you most comfortable. The best financial planning strategies are the ones you believe in and can stick to.

Additional Considerations

There are some circumstances where additional considerations must be made. When you claim might look different if you are disabled, divorced, or widowed.

Can I Claim Social Security While Working?

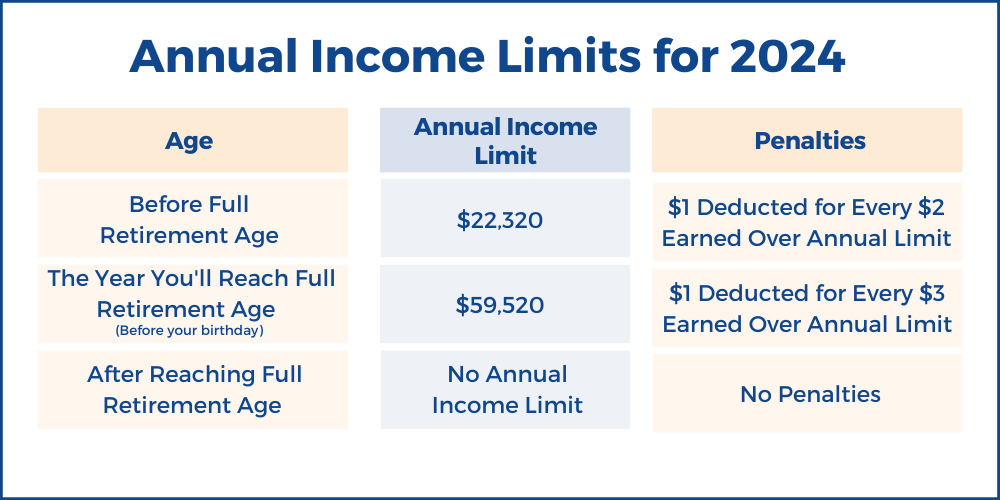

While Social Security and retirement often go hand-in-hand, they don’t have to. You can claim Social Security while working, but there are annual income limits that may reduce your benefits. The income limit is tied to when you started claiming benefits. Note that this reduction is NOT permanent. Once you stop working, you will recoup the reduced benefits.

Do Social Security Benefits Reflect Inflation?

With inflation on the rise, many worry the purchasing power of their Social Security benefits is eroding. However, like inflation, your Social Security benefits are tied to the Consumer Price Index (CPI). The CPI measures the monthly price change for a basket of goods and services typically bought by U.S. consumers.

The government adjusts the benefits payable for Social Security recipients annually, otherwise called a Cost-of-Living Adjustment (COLA). The goal of an annual COLA is to protect consumers who live on a fixed income. By adjusting their benefits to match inflation, they protect Social Security recipients’ purchasing power. COLA is for everyone, including current and future recipients.

For those who are currently delaying Social Security, your anticipated monthly benefit will have two adjustments. The government will adjust for every month you delay but will also add the inflation adjustment at the end of the year.

The Bottom Line

There are many intricacies to consider when collecting your benefits. You must take into account your life expectancy, retirement status, and additional assets. Choose wisely, the decisions you make now about Social Security can impact your future benefits.