Share this

Should I Take Pension Payments or a Lump Sum?

by Exchange Capital Management

%20-%207-6-23.png?width=1600&height=900&name=Image%20-%20Blog%20Image%20-%20WSA%20-%20Should%20I%20Take%20Pension%20Payments%20or%20a%20Lump%20Sum%20-%20MoneyJoy%20(Color)%20-%207-6-23.png) If you’re fortunate enough to have a pension plan upon retirement, you'll have to decide how you want to receive the benefit: as a monthly pension payment or as a lump sum payment.

If you’re fortunate enough to have a pension plan upon retirement, you'll have to decide how you want to receive the benefit: as a monthly pension payment or as a lump sum payment.

Because the options are designed to be roughly equivalent, your election of one form of payment over another should be less about monetary value and more about other factors such as life expectancy, spending habits, the desire to leave money to heirs, the financial health of your former employer and, of course, your risk tolerance.

Why Choose Monthly Payments?

The main advantage of a monthly pension payment is having a predictable stream of income for life. Monthly payments may make sense for you if:

You expect to live a long life: Life expectancy plays a major role in your pension. With pension payments, you will receive monthly deposits until you pass away. While your employer must pay you for the remainder of your life, they often will use your actuarial life expectancy to have a general idea of how long you’ll be receiving payments.

To find your life expectancy, you can use the Social Security Calculator. Remember this tool provides an average and your environment, genetics, and lifestyle can play a significant role in how long you live. If you choose a lump sum option, they will use your life expectancy to determine how much your payment should be. If you suspect you may live longer than the average, you should consider pension payments as you may get more value out of the plan.

You trust the financial strength of your former employer: By choosing to receive pension payments, you’re essentially trusting that your former employer will continue to pay you. However, pension plans can fail.

Fortunately, there is a silver lining for some: if you have a private-sector defined-benefit pension plan, the Pension Benefit Guaranty Corporation will step in and provide a safety net. This means that most individuals will have a portion, or their entire missed payment replaced, ensuring some level of financial security.

You need help budgeting: If you struggle with keeping a consistent budget, monthly pension plans can help. Collecting your retirement benefit in the form of a monthly pension puts your consumption habits on a disciplined, healthy diet.

You’re married: Pensions allow for a joint-and-survivor option in return for a lower monthly payout. Choosing a pension plan with this option can provide continued financial security for the surviving spouse even after you're no longer around.

Monthly Payment Options

If you’ve decided to receive a monthly pension payment, you have several choices to consider. While there is a range of pension payment types available, here are the most basic options:

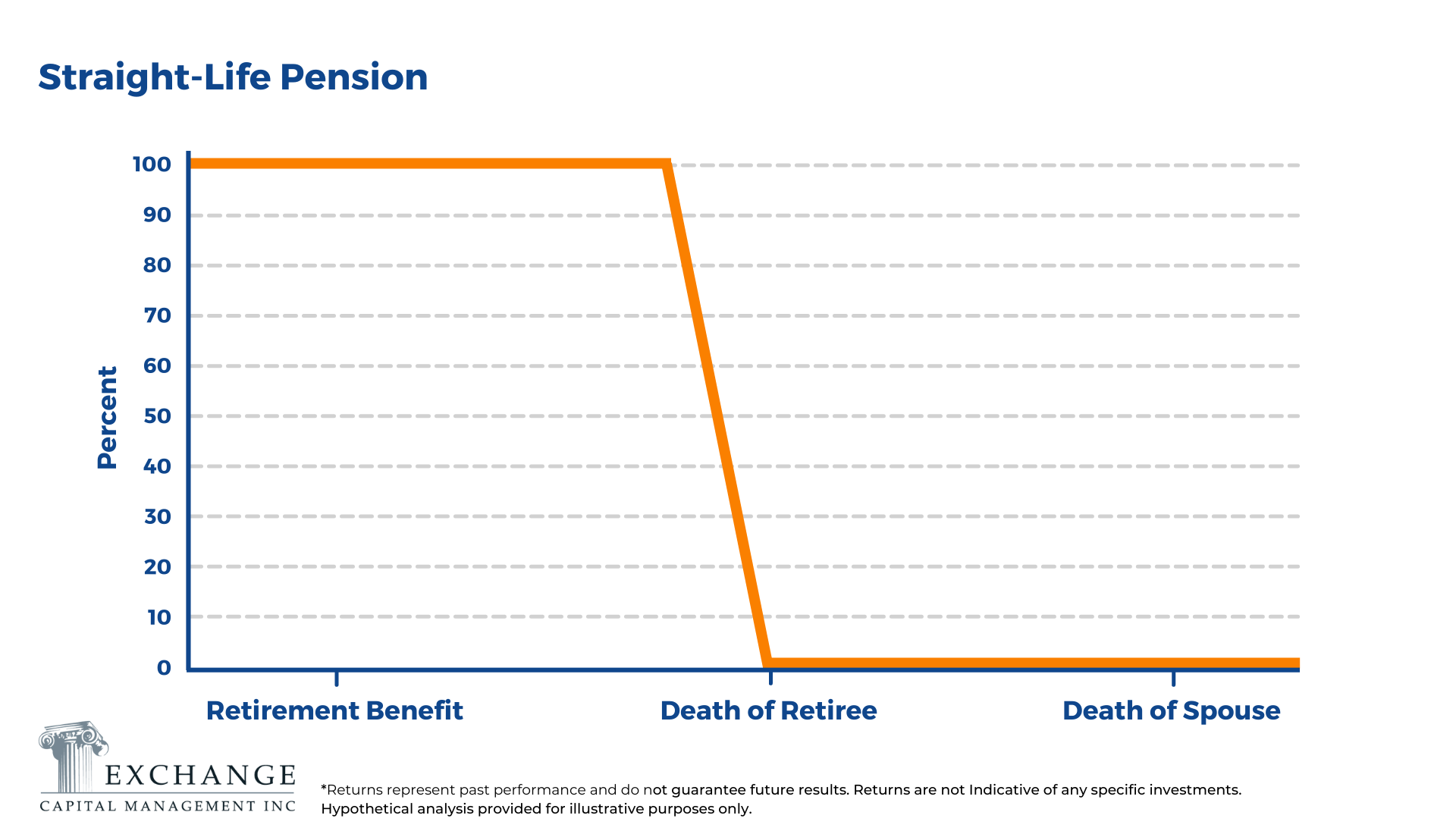

Straight-life Pension: The straight-life pension will maximize your monthly payments and guarantee income for as long as you live, with all payments ending at your death. This is the best option for those who want to get the highest monthly payment and don’t need to leave benefits for a surviving partner.

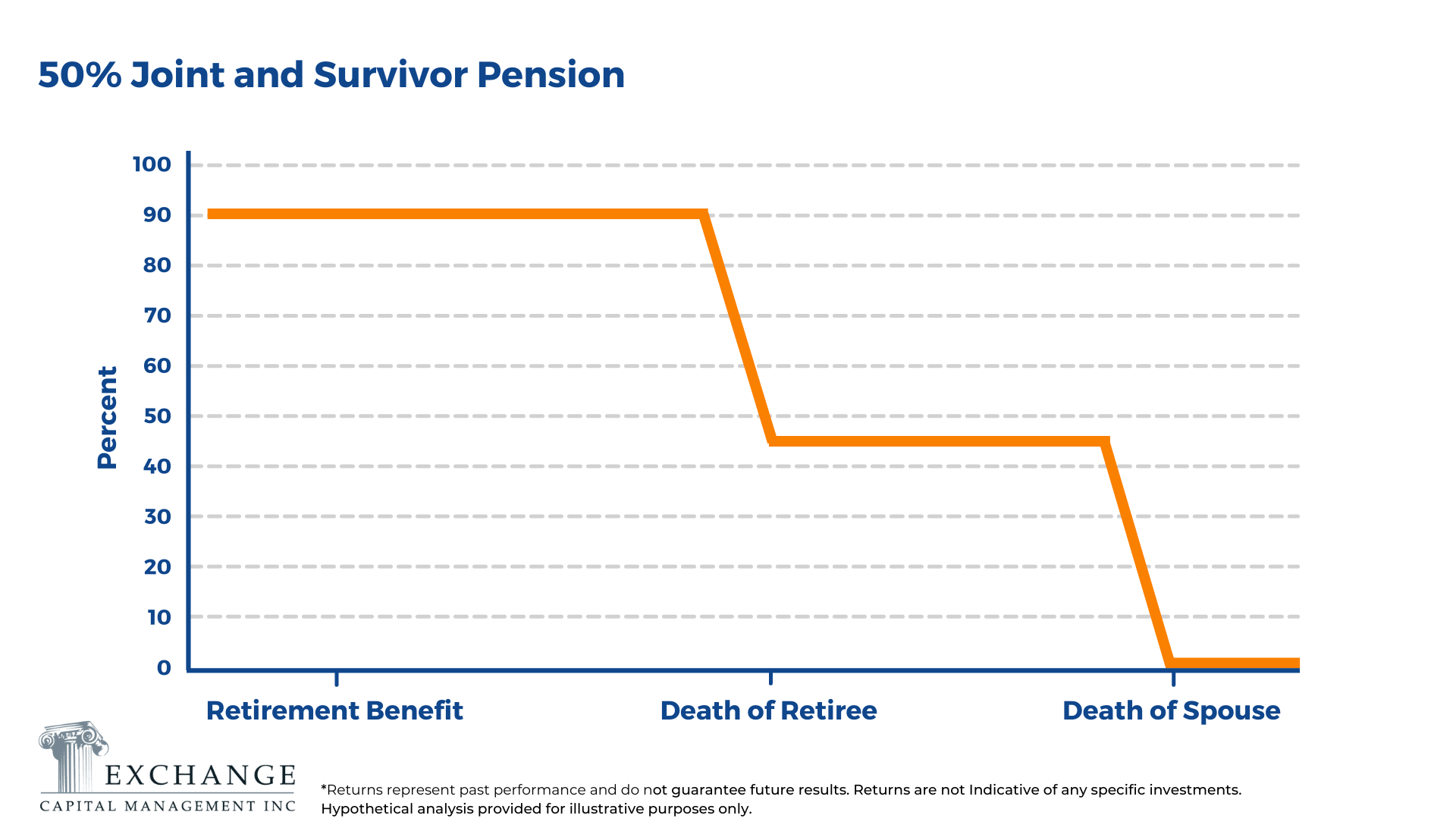

50% Joint and Survivor Pension: In exchange for the assurance that your spouse or partner will continue to receive benefits after your passing, you agree to receive a slightly reduced benefit during your lifetime.

The exact amount of the reduction in your benefit is an actuarially driven calculation that considers the age of both you and your beneficiary and is essentially the equivalent of the straight life pension stretched over two lifespans. The chart below presents the 50% joint-and-survivor glide path, but alternate forms of survivor protection (25%, 75%, pop-up) are usually available.

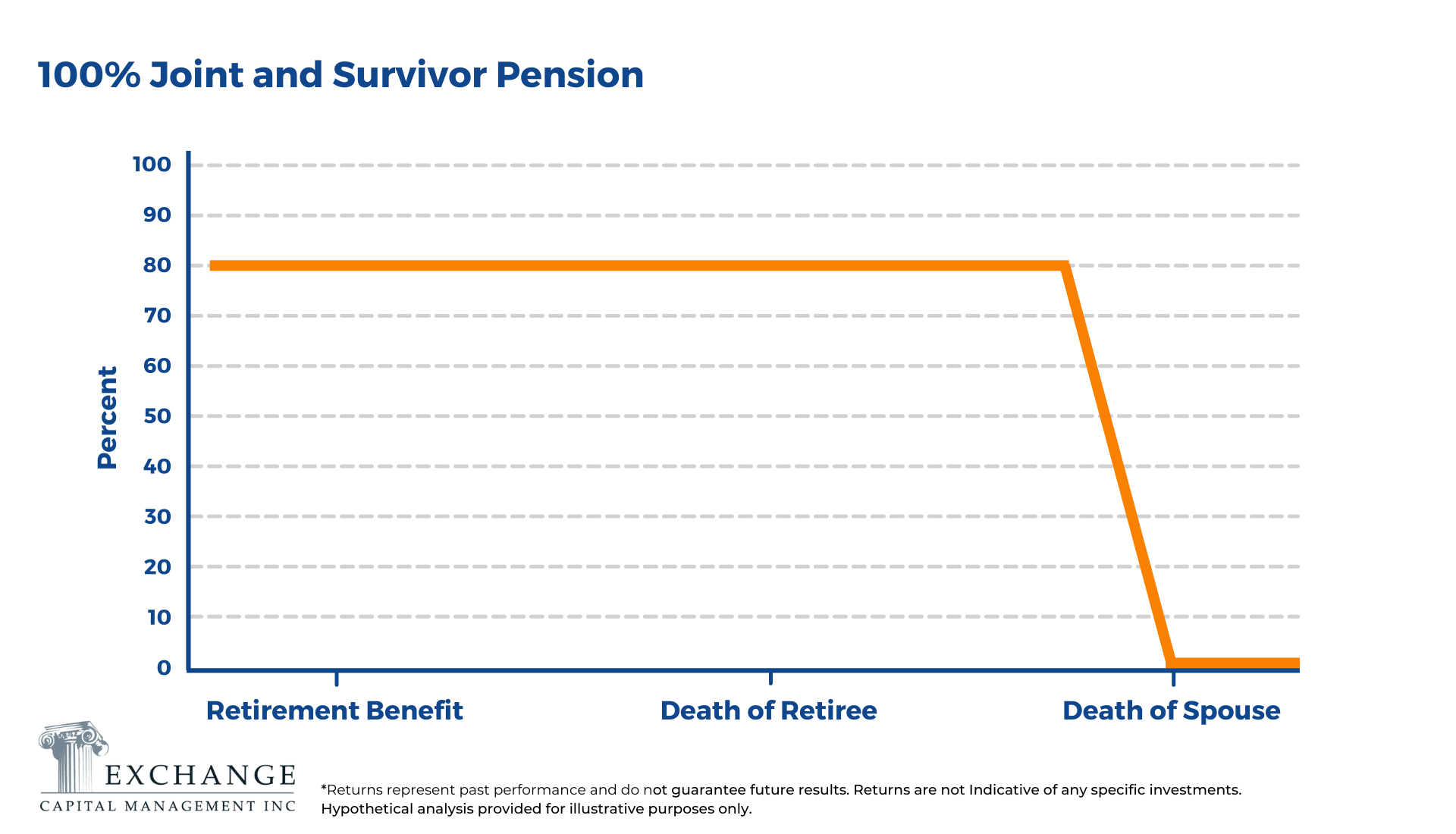

100% Joint and Survivor Pension: This option offers the lowest monthly payout but ensures that the surviving spouse or partner receives the same monthly payment as the original account owner throughout their lifetime.

This provides a high level of financial security for the surviving individual. Although the starting payment amount may be lower compared to other options, the overall benefit is structured to provide continued support over two individual life expectancies.

Why Choose a Lump Sum Payment?

The main advantage of receiving a lump sum payout is receiving all your money right away. Consider these factors when deciding if a lump sum payment is right for you:

You’d rather invest: Taking a lump sum of your pension allows you to have control over your retirement funds and allocate them according to your own investment strategy. With the ability to choose your investments, you have the potential for greater returns and the opportunity to tailor your portfolio to your specific financial goals and risk tolerance.

You want to leave a legacy: If leaving money to your children, grandchildren or favorite charity is among your end-of-life priorities, selecting the lump sum option probably holds the best chance of achieving that goal. It allows you to take control of the assets and transfer any amount remaining after your passing.

You don’t need the income: If you (and your spouse) have already secured retirement funding through alternative sources like another retirement plan or savings account, opting for a lump sum payment could be a good choice. It grants you the freedom to spend, save, and donate the money as you see fit.

You have a shorter life expectancy: If health is a real concern, enough so that it seems unlikely you will outlive the age the social security life expectancy table suggests, then capturing your retirement dollars in a lump sum is almost always the right choice.

If you choose to receive a lump sum payment, it's important to do a direct rollover to an Individual Retirement Account (IRA) or qualified retirement plan. This will delay paying income tax until you withdraw the funds from the account. Keep in mind that it must be a rollover, not a deposit, in order to be successful. Taking the lump sum and depositing it into an IRA is not allowed and will trigger income taxes.

The Bottom Line

The decision to take your pension as a monthly payment or a lump sum depends on your needs. While a lump sum can give you more flexibility with the cash, pension payments can ease anxiety by giving you a steady income and ensuring your partner is taken care of after your passing. If you're still deciding, check out our free flowchart for a visual recap on which payment method makes sense for you.