Share this

Do I Have to Pay Taxes When I Sell My Investments?

by Exchange Capital Management

%20-%202-22-23.png?width=1600&height=900&name=Image%20-%20Blog%20Image%20-%20WSA%20-%20Do%20I%20Have%20to%20Pay%20Taxes%20When%20I%20Sell%20My%20Investment%20-%20Taxes%20(Color)%20-%202-22-23.png)

Investing helps you reach your financial goals, but it will also come with tax implications. The first things to consider when you’re assessing your tax liability for an investment are what type of account it’s held in and what type of investment it is.

Qualified accounts (such as individual retirement accounts and employer-sponsored retirement plans) are tax-deferred and therefore do not bear tax consequences on the investments held within. On the other hand, taxable accounts (such as brokerage accounts) will create a tax consequence on any profits made once you sell the investment. How much you owe is also dependent on how much the investment has gone up since you bought it.

How Long Did I Hold the Investment?

When you sell an investment for more than you bought it for, the difference is considered a capital gain. Capital gains are typically taxed at a lower rate than ordinary income, but the tax rate will depend on how long you held the investment and your overall income.

Short-term capital gains: Investments held less than a year are taxed at your ordinary income tax rate. Ordinary income tax can range anywhere from 10% to 37%.

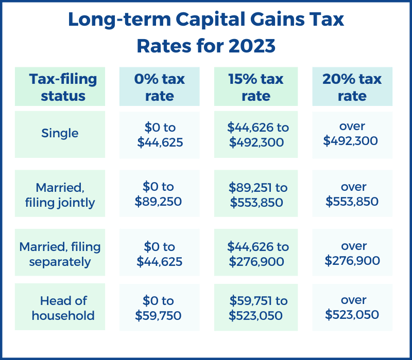

Long-term capital gains: Investments held for over a year will be taxed differently. There are three tax rates you can fall under depending on your income: 0%, 15%, and 20%.

Long-term capital gains are currently taxed more favorably than ordinary income because there are only three tax brackets and more leeway with income limitations. This incentivizes individuals to hold onto their investments for longer. However, there are more taxes to consider aside from capital gains tax, which we will outline below.

Does My Residency Affect Capital Gains Taxes?

If your resident state has a state income tax and the sale results in a capital gain, you will have to pay that state’s income tax on the profit. The amount of tax liability will depend on your state’s tax rate and the amount of capital gain. While some states have no income tax, others may tax up to 7%. Each state is different, so make sure to research your specific state’s income tax.

Are There Other Taxes to Consider?

For some investors, capital gains tax is not the only tax ramification of selling an investment. Net Investment Income Tax (NIIT) is a 3.8% tax that applies to certain types of investment income, including capital gains, and is based on your income and filing status. However, this tax only applies to taxpayers with a Modified Adjusted Gross Income (MAGI) above a certain threshold. For single filers, the threshold is $200,000 and for married couples filing jointly, the threshold is $250,000.

Capital gains are included in your MAGI. An increase in your MAGI may increase other taxes, such as Social Security taxation and Income Related Monthly Adjustment Amount (IRMAA). IRMAA is a monthly adjustment to your Medicare Part B and Part D premiums if you reach a certain income threshold. In 2023, IRMAA would kick in and start increasing if single filers made more than $97,000 (or $194,000 if filing jointly) in 2021. The more income you have, the higher your premiums will be.

An increase in income from capital gains may subject you to Alternative Minimum Tax (AMT). AMT is a tax system in the U.S. designed to ensure that wealthy taxpayers pay a minimum amount of tax. Whether you’re subject to AMT will depend on your individual circumstances.

How Can I Minimize My Capital Gains Tax Bill?

If you’re seeking strategies to minimize capital gains tax, consider gifting investments to charity or your children. If you’re not interested in gifting, you can hold on to your investments for at least a year to qualify for capital gains tax rates.

If you’re charitably inclined, gifting appreciated securities is a tax-efficient way to give. Gifting securities to a qualified charity will exempt you from paying taxes on the security’s gain and provide you with a tax deduction. Alternatively, you can gift an investment to your children and they can choose to hold or sell the asset. If they decide to sell it, it will be taxed at their personal tax rate (which could be as low as 0%, depending on their income).

Another tax minimization strategy to consider is tax-loss harvesting. If you hold investments that have decreased in price, you can sell them and use the losses to offset your capital gains, thus reducing your tax bill. You must be cautious of violating the Wash Sale Rule when taking advantage of this strategy. You cannot buy the same security 30 days before or after the date of sale and realization of the capital loss. Therefore, this strategy has some significant limitations. If the investment goes up while you don’t own it, the tax benefits can be quickly erased as compared to holding the investment.

The Bottom Line

Before selling an investment, understand exactly how it affects your financial plan. Capital gains may increase your taxable income and cause other implications. However, don’t let that scare you away from investing as investing can help you reach your financial goals. Just be aware of the tax implications that come with the territory. Check out our free visual recap outlining the tax implications that come with selling an investment.