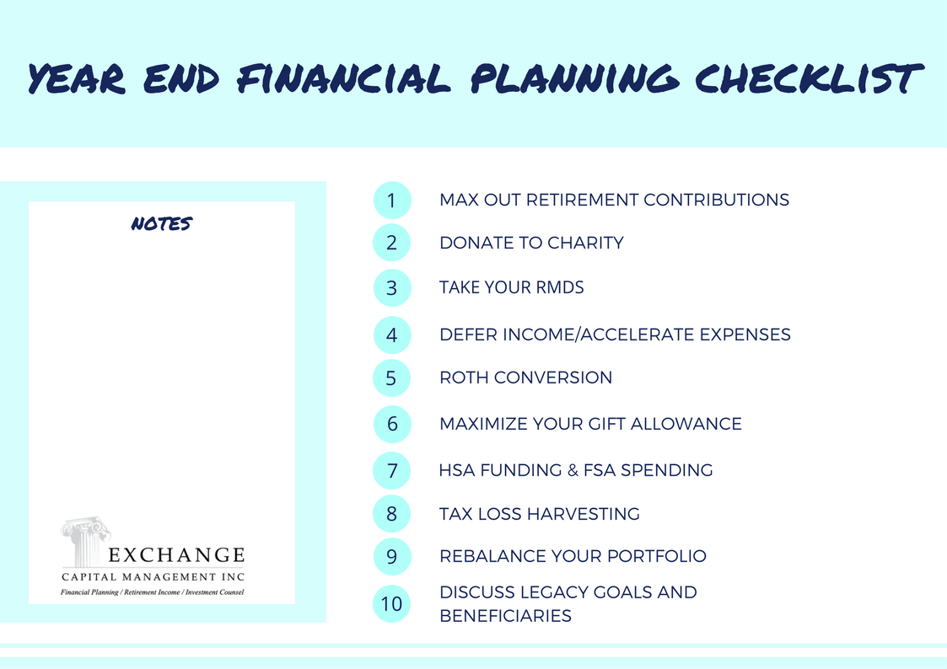

10 Items to Add to Your Year End Financial Planning Check List

With all the bustle of the holidays right around the corner, the end of the year will be here before we know it. While there’s still time, consider checking off a few of these year-end financial planning items from your to-do list.

1. Max out Retirement Contributions

You have until the tax filing deadline (April of next year) to make IRA contributions, but you can only make contributions to employer sponsored retirement plans (401(k)/403(b)/457) up until December 31st. The current 401(k) contribution limit is $18,000 with an additional $6,000 catch-up contribution amount allowed for individuals age 50 and above. Hitting those contribution limits just isn’t in the budget this year? Consider pushing any extra income from a year-end bonus toward your 401(k) or look ahead to next year and bump up your contribution amount going forward. To see all retirement income and contribution limits see our 2017 Financial Planning Cheat Sheet.

2. Donate to Charity

Charitable giving tends to tick up the closer we get to the holidays. That’s in large part due to the giving nature of the season, but also because December 31st is the cutoff for deducting gifts from current year taxes. There are a number of ways you can optimize charitable giving, as discussed here previously, but regardless of how one chooses to give, it’s important to be mindful of the year-end deadline.

3. Take Your RMDs

Forgetting to take required minimum distributions from an IRA, or other tax-deferred retirement account, results in a 50% tax penalty on the amount that should have been withdrawn. For anyone who is over the age of 70 ½, or the beneficiary of an inherited IRA, that’s a very costly oversight you want to be sure to avoid!

4. Defer Income / Accelerate Expenses

This is likely most relevant for small business owners, as they can better control their own income. If you have the option, perhaps delaying year-end billing into the next calendar year will limit current year earnings and keep you in a lower tax bracket. Not a small business owner? See if a bonus or commission payment you’re due from your employer can be pushed back to January 1st. Alternatively, if there are any tax-deductible expenses that can be moved up like prepaying property taxes, you can reduce this year’s tax liability.

5. Roth Conversion

Whether a Roth conversion is right for you depends on a number of different factors, but the potential long term benefits make it something worth revisiting each year. Any amount converted from a traditional IRA to a Roth IRA counts towards ordinary income. Consider taking advantage of a year when you have lower taxable income or large amounts of capital losses to pay conversion taxes while in a lower tax bracket. This will allow you to enjoy tax-free growth and tax-free withdrawals on the converted amount later in retirement. Also, unlike other traditional retirement accounts, Roth IRAs are not subject to RMDs.

6. Maximize Your Gift Allowance

Where estate tax thresholds will be at this time next year, let alone at the time of one’s death is anybody’s guess. For those worried that they may have significant enough assets for the estate tax to be imposed, consider gifting money away prior to passing. Gifts of $14,000 per person ($28,000 per couple) can be made each year to any number of individuals without counting towards your lifetime estate/gift tax exemption.

7. HSA Funding & FSA Spending

HSA’s (Health Savings Accounts) have triple tax benefits - contributions are made with pre-tax dollars, earnings grow tax-free, and distributions are tax-free as long as they are used towards qualified medical expenses. If you have a high deductible health savings plan, consider funding up to $3,400 for individuals/$6,750 for a family as this isn’t a “use it or lose it” account. Contributions not spent will grow over time and can be taken in later years when health expenses are higher.

FSA’s (Flexible Spending Accounts) are a bit different in that you generally can’t carry over balances between calendar years so you want to make sure you use any funds remaining for qualified medical and childcare expenses before December 31st.

8. Tax Loss Harvesting

Nobody likes seeing securities lose value. But if you’ve accumulated losses within a taxable investment account, there’s an opportunity to at least save on taxes. By harvesting losses, you can reduce realized short and long term gains by an equal amount as well as write off up to $3,000 of taxable income. No gains or income to offset your losses? No problem. You can carry them forward indefinitely for use in future years.

9. Rebalance Your Portfolio

Checking in on how your portfolio is doing is ideally more than just a year-end chore. Haven’t looked at your account in awhile? Take the time to make sure it’s positioned the right way to start the new year off on the right foot. As market movements have likely altered your asset allocation, you need to rebalance back to targets in order to reset your portfolio risk to the level you initially deemed appropriate.

10. Discuss Legacy Goals and Beneficiaries

If you’re lucky enough to spend some time with family over the holidays, it could be a good opportunity to share your legacy intentions with loved ones. Consider sharing what you’ve outlined in a will and/or trust, as well as who you’ve listed as account beneficiaries and who will have power of attorney for financial and medical decisions down the road. How about your parent’s wishes? Do you know what arrangements they’ve made? While talking about money and death doesn’t exactly go hand in hand with eggnog and pumpkin pie, having an open conversation about these things now can help ensure financial legacies are carried out as intended.

Not sure which of these you might be able to take advantage of before December 31st? Schedule a meeting with your financial advisor and/or accountant during the calm before the holiday storm to help review, organize, and get help if you need it.

Comments

Market Knowledge

Read the Blog

Gather insight from some of the industry's top thought leaders on Exchange Capital's team.

Exchange Capital Management, Inc.

110 Miller Ave. First Floor

Ann Arbor, MI 48104

(734) 761-6500

info@exchangecapital.com