The Market Has Done Worse Than You Think

%20-%20Sad%20Bull%20Image%20-%20JPED%20-%202-28-2020.jpg?width=945&name=Image%20-%20Blog%20Image%20-%20Andy%20-%20The%20Market%20Has%20Don%E2%80%99t%20Worse%20Than%20You%20Think%20(updated%20)%20-%20Sad%20Bull%20Image%20-%20JPED%20-%202-28-2020.jpg) When speaking with clients, peers, and friends alike, there are some common questions: "When will this bull market end?" or "It's too late to buy stocks, right? They have to go down from here." Sometimes they even use the word "bubble!" The short answer is: I have no idea and anyone who tells you they do is probably lying, misguided, or foolish. The long answer is more complicated, and involves taking many factors into consideration, especially global interest rates. Also, bubbles require exuberance and leverage. The fact that the questions above are being asked so often indicates that exuberance is low and leverage likely is too.

When speaking with clients, peers, and friends alike, there are some common questions: "When will this bull market end?" or "It's too late to buy stocks, right? They have to go down from here." Sometimes they even use the word "bubble!" The short answer is: I have no idea and anyone who tells you they do is probably lying, misguided, or foolish. The long answer is more complicated, and involves taking many factors into consideration, especially global interest rates. Also, bubbles require exuberance and leverage. The fact that the questions above are being asked so often indicates that exuberance is low and leverage likely is too.

Before one even attempts to start prognosticating the future, though, we need to agree on the past. It's not uncommon for laymen and experts alike to claim that this market has gone "straight up" when, in fact, the S&P 500 has had five downturns greater than 5% in the past three years. Two of them were over 10%! Let's take a look at these declines:

Fall 2014: down 7%, starting in mid-September. The market was concerned that the Fed would raise rates too quickly. Meanwhile, there were protests in Hong Kong and the Ebola outbreaks.

The market recovered by Halloween.

Summer 2015: down 12%, starting mid-July. Is China's growth slowing down faster than expected? Oil prices fall. Corporate earnings forecasts are gloomy.

By a few days after Halloween, the market was almost at a new high.

The rest of 2015 was marked by a sideways moving market with some blips of volatility. We were all obsessed with what would happen when the Fed started raising short term interest rates. Lots of hand wringing around:

- "I hope they finally do it, they should have done it a year ago!" (although see Fall 2014 concerns above) versus...

- "Sure, a year ago would have been fine, back when the economy was strong, but did we miss our chance to raise without ruining the economy?" versus...

- "Europe just lowered rates, are you sure we should be raising?" versus...

- "Who knows what will happen! We've never been here before! Just do it!"

We managed to almost get to the New Year's Eve 2015 when...

2016 First Quarter: down 12%, starting December 30th, 2015. If you were watching financial television (hopefully you spend your time doing more important things), it was a hectic scene. China really is in trouble! Can oil go to $10 a barrel?! The Fed probably killed the economy last month when they raised rates, what were they thinking?!

April Fools! The market reached a new high on the first day of the second quarter.

The rest of 2016 was marked by significant political volatility, you may remember, and the markets were not immune to it. In increasingly shorter time periods, though, the losses were recovered.

Brexit on June 23rd: down 5% over two days. Closed at a new high on July 8th.

Election Night 2016, after it became clear that Trump was going to win, the overnight S&P 500 futures market was halted after declining 5%. The next morning, the market opened higher than the previous day's close.

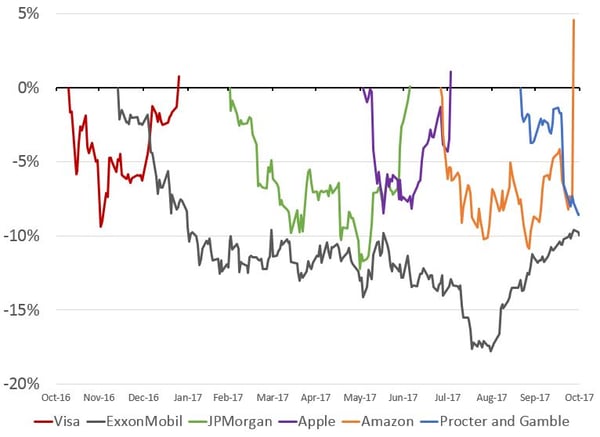

Since then, the overall market hasn't experienced a drawdown greater than 5%, but many individual stocks have, including household names such as JPMorgan, Apple, Amazon, and many more. They just aren't doing it together.

So, what does all this mean? First off, the market has been willing to fall in price when bad news comes out. The "straight up" narrative is a false one. Furthermore, when you look at individual companies, they are not all moving in lockstep all of the time. The market is paying attention to the news and fundamentals of those companies. The recoveries that we see in the market (and individual companies' stock prices) are also primarily driven by real news: the Fed is raising rates slowly, China hasn't been in a downturn, Brexit will be done slowly, and most importantly, the global economy is growing and many companies are profitable. Yes, asset prices are higher than their long-term averages, but it doesn't seem as though the market is enthusiastically running up in a leverage fueled, bubbly bout of "irrational exuberance." Indeed, many investors in the market seem to be buying stocks begrudgingly, only because the less historically risky assets they would prefer (e.g. bonds) aren't providing the returns they need.

That type of behavior dovetails well with a theory that might explain the quick recoveries outlined above: the Global Financial Crisis led to new attitudes of risk aversion among investors, individuals and institutions alike. These same investors are painfully aware of the opportunity cost they have endured by not having been invested appropriately over the past 8+ years. Then, every time the market takes a downturn, these investors determine that they are being given an opportunity to purchase stocks at a discount. They emotionally don't want to buy, but their analysis convinces them they need to, and at least they're getting a "deal." They use some (but not all) of the cash they've been sitting on for all these years and buy stocks, helping to fuel a recovery that also has reasonable economic data behind it.

That said, this market environment does provide a challenge for all of us who need to be invested in the markets to reach our goals. A portion of your assets likely need to be invested in the stock market, because while a downturn from here would be painful, you can't afford the risk of missing out on potential gains from here either. Step one to figuring this out is having a properly built financial plan that helps you determine how much risk you need to take. After your plan is built, paying regular attention to your portfolio and reacting to changes inside that portfolio will steer you along your plan to your goals. Partnering with a fiduciary financial advisor will make both of these tasks easier to complete.

Andrew Stewart, CFA is a Senior Portfolio Manager at Exchange Capital Management, a fee-only, fiduciary financial planning firm. The opinions expressed in this article are his own.

Comments

Market Knowledge

Read the Blog

Gather insight from some of the industry's top thought leaders on Exchange Capital's team.

Exchange Capital Management, Inc.

110 Miller Ave. First Floor

Ann Arbor, MI 48104

(734) 761-6500

info@exchangecapital.com