The Best Securities to Donate to Support Charity

%20-%205-12-2020.png?width=945&name=Image%20-%20Blog%20Image%20-%20Andy%20-%20The%20Best%20Securities%20to%20Donate%20to%20Support%20Charity-%20Pawprint%20(Colored)%20-%205-12-2020.png) There have always been worthwhile causes for each of us to support with our time and treasure, but times like these have accentuated the need. Whether it's a front-line health organization like a non-profit hospital, a safety net charity like a food pantry, or supporting the community orchestra to avoid a permanent shutdown, there are many worthwhile causes for you to support if you have a little extra. Before you reach for your checkbook, you might be able to lighten the load come tax season, because the tax law is written to reward your good deed. Regular readers might remember that we've already written about donating tax efficiently and your limited options to avoid capital gains taxes, but I want to go one step further as a portfolio manager. Suppose that you have already decided to donate an appreciated security to a worthwhile charity. How do you decide which to donate?

There have always been worthwhile causes for each of us to support with our time and treasure, but times like these have accentuated the need. Whether it's a front-line health organization like a non-profit hospital, a safety net charity like a food pantry, or supporting the community orchestra to avoid a permanent shutdown, there are many worthwhile causes for you to support if you have a little extra. Before you reach for your checkbook, you might be able to lighten the load come tax season, because the tax law is written to reward your good deed. Regular readers might remember that we've already written about donating tax efficiently and your limited options to avoid capital gains taxes, but I want to go one step further as a portfolio manager. Suppose that you have already decided to donate an appreciated security to a worthwhile charity. How do you decide which to donate?

This is not a trivial question, and it depends upon a number of factors:

- What does your portfolio look like now?

- What do you want your portfolio to look like after you make the donation?

- Are you willing to pay some taxes now and to avoid paying more taxes later?

How Hard Can It Be to Give Away Money?

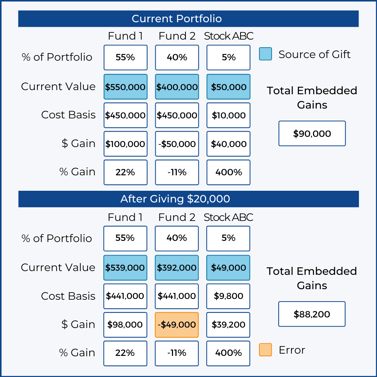

The actual process of gifting a security is fairly easy with a form from your custodian, but they will require you to tell them which securities to send to the charity. The custodian won't pick for you. If you don't care about your tax bill, you could simply give whatever securities are appropriate to rebalance your portfolio to where you want it to be. Let's examine how that could be folly. Suppose your portfolio is already exactly where you want it, and you just give a little of everything: Your total embedded gains went down (good), but you gave away some of the fund that had an embedded loss (bad).

Your total embedded gains went down (good), but you gave away some of the fund that had an embedded loss (bad).

Rule: Only donate securities with an embedded gain.

Do not donate securities that could be sold at a loss. If you have multiple lots of the same security, avoid donating the lots that are at losses. If all you have are at losses, abandon this endeavor, sell the shares, book the tax loss, and donate cash.

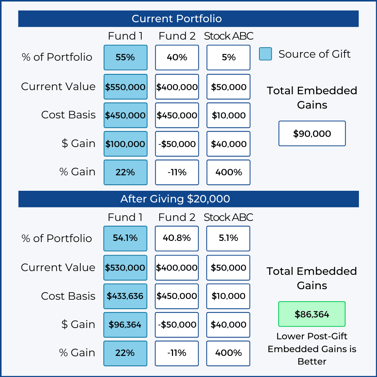

You can do even better, in the long-term, if you can tolerate booking some taxable gains now. Look at what happens when someone follows the simple rule above, but just picks the single security with the largest dollar gain. This isn't bad: the remaining embedded gain is lower than the first scenario (meaning you gave away more of your tax liability). A small trim of the other two securities will free up cash to buy back some of the security you donated and your portfolio is back where you want it. In this stylized example, your net capital gains taxes are slightly negative (a good thing), but if you take a longer view, you can do even better.

This isn't bad: the remaining embedded gain is lower than the first scenario (meaning you gave away more of your tax liability). A small trim of the other two securities will free up cash to buy back some of the security you donated and your portfolio is back where you want it. In this stylized example, your net capital gains taxes are slightly negative (a good thing), but if you take a longer view, you can do even better.

Let's see how we can donate this gift in such a way that your overall tax liability is decreased as much as possible.

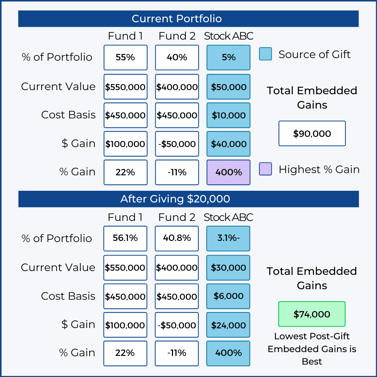

Suggestion: Donate the highest percentage gain securities first.

While the eye is more easily drawn to the large dollar amounts in a portfolio, most portfolio management tasks are better performed with percentages in mind. In this portfolio, the smallest position, a stock that has that quintupled in price, is the best candidate for donation. Even if you think that Company ABC is a great stock that you want to continue to own, your tax liability will be lower if you donate that position and re-buy new shares of it with cash raised from selling the other two positions. You may generate some capital gains now while trimming those other parts of the portfolio, but your total tax liability over the coming years is made lower by donating your highest percentage gain position.

You may generate some capital gains now while trimming those other parts of the portfolio, but your total tax liability over the coming years is made lower by donating your highest percentage gain position.

It is a joy to do what we can to make the world a better place. We can experience a little joy ourselves when the IRS lets us save a bit on tax day. Crunching numbers in a brokerage statement is likely not the most joyful part of the process for you, but if you take the time, you can save even a bit more.

Comments

Market Knowledge

Read the Blog

Gather insight from some of the industry's top thought leaders on Exchange Capital's team.

Exchange Capital Management, Inc.

110 Miller Ave. First Floor

Ann Arbor, MI 48104

(734) 761-6500

info@exchangecapital.com