Should I Take My Pension as a Lump Sum?

%20-%20PNG%20-%2012-14-2021.png?width=1600&name=Image%20-%20Blog%20Image%20-%20Kevin%20-%20Retirement%20Riddle%20-%20Should%20I%20take%20my%20pension%20as%20a%20lump%20sum%20-%20Puzzle%20Man%20(color)%20-%20PNG%20-%2012-14-2021.png) Do you work for a company that offers you retirement benefits in the form of a traditional pension plan? If so, consider yourself a (fortunate) dinosaur. Traditional pensions, also knows as defined benefit plans, promise employees a certain amount in retirement, specifically, monthly payments for life. These kinds of plans have become less common as companies switch to 401(k) or other types of defined contribution plans, where no benefit is guaranteed in retirement.

Do you work for a company that offers you retirement benefits in the form of a traditional pension plan? If so, consider yourself a (fortunate) dinosaur. Traditional pensions, also knows as defined benefit plans, promise employees a certain amount in retirement, specifically, monthly payments for life. These kinds of plans have become less common as companies switch to 401(k) or other types of defined contribution plans, where no benefit is guaranteed in retirement.

When a participant in a traditional pension is about to retire (or offered a voluntary retirement package) they are often presented with the option to take their benefit as either a pension or as a lump sum. This pension versus lump sum decision can be distilled to one central question: Who should bear the risk, and responsibility, of your retirement nest egg; your former employer, or you?

Because the options are designed to be roughly equivalent (Time Value of Money), your election of one form of payment over another should be less about monetary value and more about other factors such as life expectancy, spending habits, the desire to leave money to heirs, the financial health of your former employer and, of course, your tolerance for risk.

More than Math

Deciding whether a pension or lump sum is the better choice for you is a complicated math problem with variables you cannot predict, most notably, how long you will live. If you choose the pension and die prematurely, you (and your heirs) will receive far less than the lump sum you rejected. Alternately, if you take a lump sum and live beyond your actuarially determined life expectancy, you run the risk of running out of money.

According to the Social Security Administrations Retirement & Survivors Benefits: Life Expectancy Calculator, a 65-year-old man will live to 84, a 65-year-old woman to 87, and a married couple at 65 has a 50% chance one spouse will live to 92. Stated another way, there is a pretty good chance that a 65-year-old couple will need to draw on their retirement assets for more than a quarter of a century.

Pension – The Good, the Bad, and the…Who the Heck Knows?

Main Advantage: A known and predictable, monthly stream of income for life.

When it makes sense…

You are married. Pensions allow for a joint-and-survivor option in return for a lower monthly payout. If you suspect your spouse may outlive you, rejecting this benefit can hurt.

You are anxious. The knowledge that your pension payment will arrive like clockwork, every month without fail, can offer much-needed peace of mind.

You are healthy. Do you ever look at the social security life expectancy tables and think you are in better health than your peers? If so, you can capture more than your fair share if you outlive the actuarial estimate.

You like to spend. For better or worse, collecting your retirement benefit in the form of a monthly pension puts your consumption habits on a disciplined, healthy diet.

Cognitive decline. Let’s face it, our decision-making ability declines with age, leaving us vulnerable to abuse, fraud, and self-destructive investment traps.

… and when it does not.

You fear inflation. Most pensions carry little, if any, adjustment in benefit significant enough to fend off the adverse impact inflation can have on your purchasing power.

You are concerned about the financial strength of your former employer. Remember, your pension is little more than a promissory note from your former employer. Pension plans do fail and, although the Pension Benefit Guaranty Corporation would likely replace your lost payments, the disruption to your cash flow could be material.

Unexpected expenses. Most of us live our lives with a clear idea of the expense side of our personal income statement. This may be true in retirement…right up until it is not. Every so often, you may be faced with a large, unexpected expense that is well more than your monthly benefit.

Pension Payment Choices – No Free Lunch

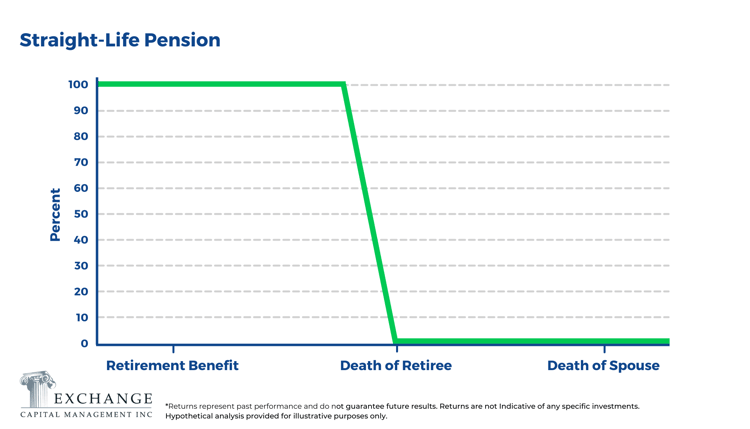

The highest initial form of payment (monthly payments for the full life of the retiree) is often called a straight-life pension. This option will pay you a certain amount each month for as long as you live, with all payments ending at your death. For both you and your former employer, this calculation is the starting point, or anchor, by which all other pension payment options are derived.

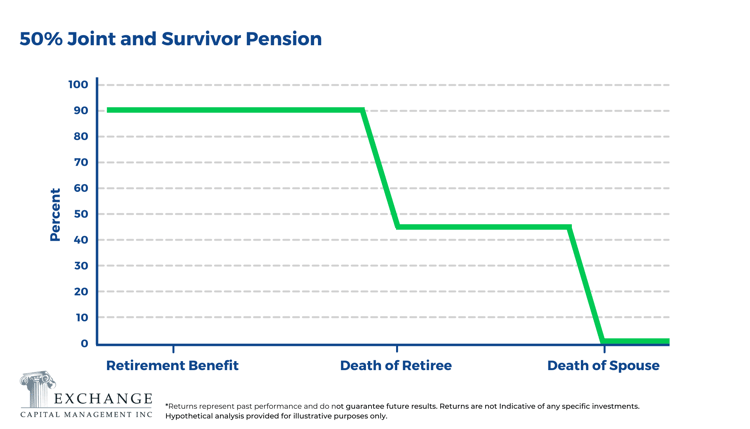

One notch down from the straight-life payment stream is the offer of a joint-and-survivor pension. Here, in return for the promise of a continuation of benefits to a survivor (usually a spouse or partner) for the duration of their life, you accept a somewhat reduced benefit over the course of your life. The exact amount of the reduction in your benefit is an actuarially driven calculation that considers the age of both you and your beneficiary and is essentially the equivalent of the straight-life-pension stretched over two lifespans. The chart below presents the 50% joint-and-survivor glidepath, but alternate forms of survivor protection (25%, 75%, pop-up) are usually available.

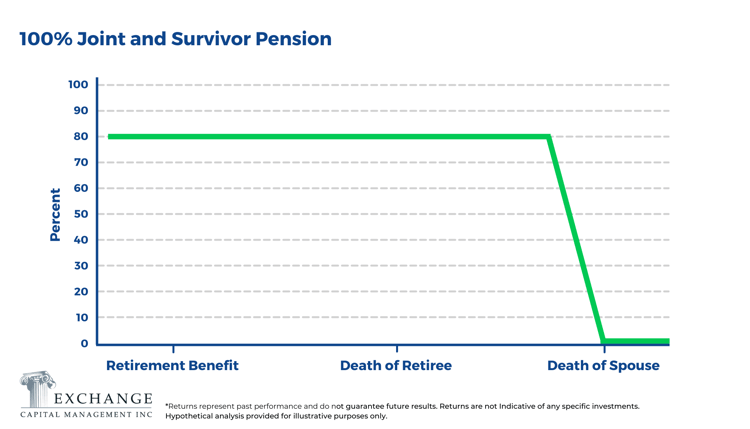

Finally, the lowest dollar starting point for the collection of your retirement benefit is a monthly payment based on a 100% joint-and-survivor promise. In this option, the monthly payment starts at one set level and continues at that same level for so long as either spouse or partner is alive. Again, the overall benefit amount is designed to be equivalent to the anchor (straight-life) but is simply distributed differently over two lifetimes.

Lump Sum – Pros and Cons

Main Advantage: The freedom to invest your money, your way, right now.

When it makes sense…

You are an experienced investor. If you enjoy the ‘challenge’ of investing and are committed to spending the time and energy your retirement nest egg truly deserves, taking the lump sum offers more flexibility and, potentially, more upside. Toss in a fiduciary financial adviser you know and trust, and the lump sum choice becomes even more compelling.

You do not need the money. If you (and your spouse) are already covered for retirement funding — perhaps from another retirement plan or inheritance — taking the lump sum allows you to spend, save and give however you choose. With this choice, you roll your lump sum into an IRA and defer taxation until you withdraw.

You are concerned about your health. If health is a real concern, enough so that it seems unlikely you will outlive the age the social security life expectancy table suggests, then capturing your retirement dollars in a lump sum is probably the right choice.

Legacy matters. If leaving money to your children, grandchildren or favorite charity is among your end-of-life priorities, selecting the lump sum option probably holds the best chance of achieving that goal.

…and when it does not.

You underestimate the magnitude of the challenge. Pending retirees trying to decide between a pension or lump sum often focus on whether they could earn more by investing the lump sum. While it is a useful analytical exercise worthy of pursuit, the revelation of the ‘hurdle’ or ‘break even rate-of-return’ is only the first step. The real work begins when you realize that the stock market does not know you, does not much care about you, and is happy to separate you from your money. Market fluctuations and periodic withdrawals to meet ongoing living expenses could deplete your retirement dollars and put you, and your spouse, at financial risk.

Making the Choice

The onset of retirement - and the cessation of a steady paycheck - can create a new, and unwelcome, sense of vulnerability. And like many choices in life, few of us are fully equipped to grapple with the tradeoffs involved when considering something as irrevocable, and as unknowable, as how to maximize our hard-won retirement dollars. But you don't have to go it alone.

For help evaluating your choices, consider consulting an independent fiduciary advisor who is committed to acting in your best interest. Using the power of an objective framework, your advisor can calculate the present value of your future pension benefits using various assumptions about your life expectancy, interest rates and personal priorities, and weigh those outcomes against the lump sum alternative. If the analysis is done properly, you might be surprised at what you uncover.

Kevin McVeigh, CFA is a Managing Director and Partner at Exchange Capital Management, a fee-only, fiduciary financial planning firm. The opinions expressed in this article are his own.

Comments

Market Knowledge

Read the Blog

Gather insight from some of the industry's top thought leaders on Exchange Capital's team.

Exchange Capital Management, Inc.

110 Miller Ave. First Floor

Ann Arbor, MI 48104

(734) 761-6500

info@exchangecapital.com