Presidents, Markets, and the Anxiety They Cause

-%20Mount%20Rushmore%20-%20PNG%20-%202-25-2020.png?width=921&name=Image%20-%20Blog%20Image%20-%20Andy%20-%20Presidents%2c%20Markets%2c%20and%20the%20Anxiety%20They%20Caused%20(Updated)-%20Mount%20Rushmore%20-%20PNG%20-%202-25-2020.png)

In conversations regarding the markets this year, some have asked me: what do you think will happen to the stock market if the Trump Presidency runs into significant legal problems or even impeachment? My candid and apolitical response: all else being equal, stocks will rally after a period of distress, because markets hate uncertainty and while the current administration already has lots of it, the process of its downfall would create more.

If history tells us anything, it's this: an administration under fire can cause some pain in the markets, resolution will take a lot longer than most people expect, and the markets seem to like it when that resolution is found. Meanwhile, other things easily create more distress in the markets than the political scandal itself. For two useful points of reference, let's examine how the markets have previously responded to beleaguered modern presidents.

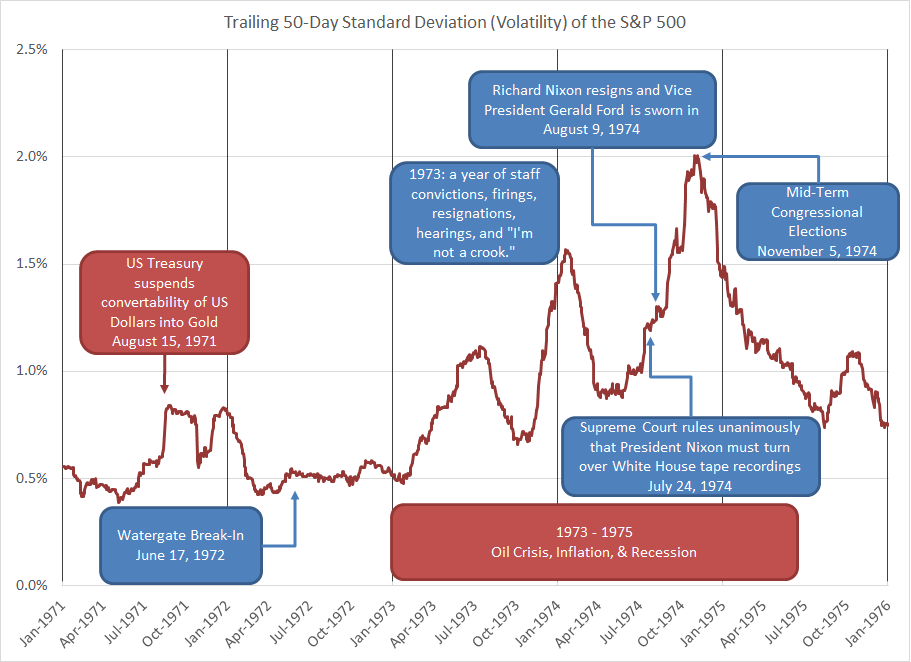

From 1971 to 1974, the Watergate Scandal unfolded, culminating with President Nixon's resignation. During those years, the short-term volatility of the S&P 500 (measured by the 50-day rolling standard deviation of daily returns) increased four-fold to a level not surpassed again until Black Monday 1987. Much of this overall anxiety could be attributed to the tortuous end of a hugely unpopular and costly war in Vietnam, while the markets were also processing an oil crisis, a recession, and high inflation that previewed the environment that would close out the decade a few years later. That said, the uncertainty of Watergate appears to have amplified what was already taking place in the economy. To see this in action, consider the chart below. Stock market volatility rose from below 0.5% in 1971/1972 (for reference, volatility was below this number for most of the first half of 2017) to a peak over 2% in the days surrounding the 1974 mid-term congressional elections that occurred a few months after Nixon resigned. From there, with the recession ending and the scandal behind us, volatility decreased and the market rallied in 1975.So, political volatility can lead to more market volatility, but what actually moves the stock market over longer periods of time? If you haven't guessed my answer already, I'll quote a slogan from the 1992 campaign of the other modern president who struggled with the Articles of Impeachment, "It's the Economy, Stupid!"

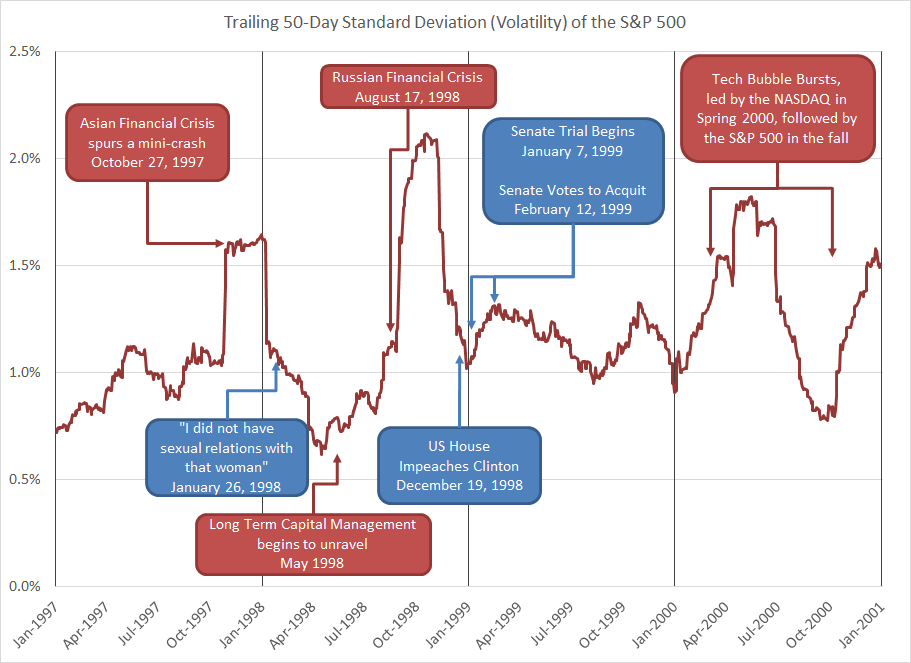

If we study a similar chart of President Clinton's last few years in office, this becomes exceptionally clear. Perhaps the market correctly guessed that Clinton's administration would survive the ordeal, but I would argue the market had other things to worry about. This time it was a pair of financial crises started on the other side of the globe, the failure of a hedge fund that threatened contagion, and finally the bursting of the dot.com bubble. Sure, the impeachment trial in the Senate coincides with a small increase in volatility, but this could be easily dismissed as spurious and even if it wasn't, it was short lived and the market went up another 20+% that year before it all came crashing down in 2000.

When I analyze the stock market, I'm much more concerned with the profitability of companies and the financial well-being of families than I am with much else, because if those are both going fairly well, the economy is going fairly well, and the stock market is simply a derivative of the economy. Whether you hope or fear for a failed Trump Administration, try to remember that neither a tweet nor an impeachment is directly related to the economy.

Andrew Stewart, CFA is a Senior Portfolio Manager at Exchange Capital Management. The opinions expressed in this article are his own.

Comments

Market Knowledge

Read the Blog

Gather insight from some of the industry's top thought leaders on Exchange Capital's team.

Exchange Capital Management, Inc.

110 Miller Ave. First Floor

Ann Arbor, MI 48104

(734) 761-6500

info@exchangecapital.com