Medicare Explained

%20-%20PNG%20-%206-22-2021.png?width=1600&name=Image%20-%20Blog%20Image%20-%20Joe%20-%20Medicare%20Explained%20-%20Frantic%20Doctor%20(Color)%20-%20PNG%20-%206-22-2021.png)

As retirement approaches, most individuals attempt to reduce complexities in life. Cutting back on working hours, outsourcing responsibilities to professionals, and exploring lifelong hobbies are all frequently discussed topics around our conference room table. Unfortunately, two topics seem to introduce more confusion than any other: Social Security and Medicare. For this post, we will focus primarily on Medicare, although there are some factors that play a role in both subjects.

What Is Medicare?

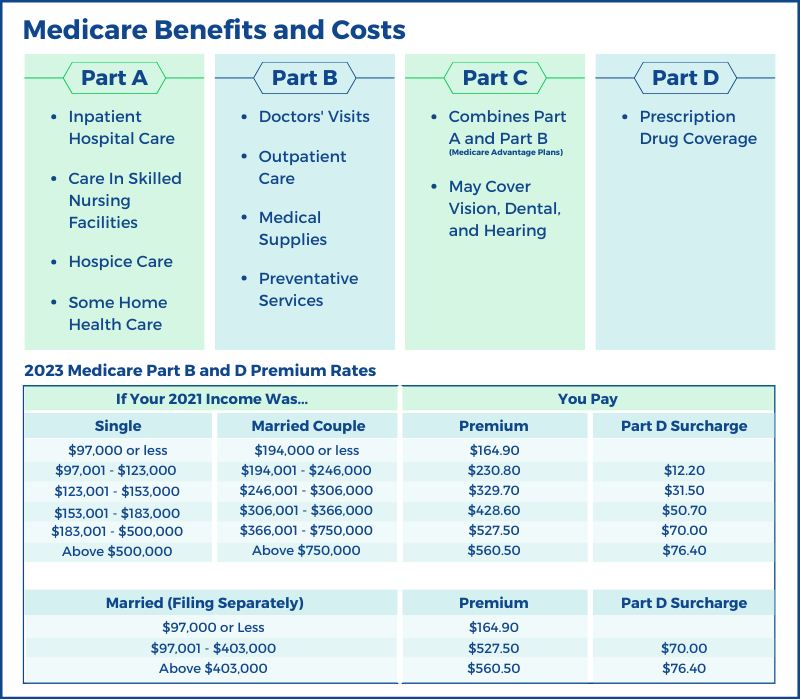

Medicare is a government run health insurance program that is primarily designed for those ages 65 and older. Younger individuals with certain disabilities are also eligible for coverage. This is not to be confused with Medicaid which is also public insurance, but for disabled and lower income adults. Simply put, insurance premiums would be far too expensive for every retiree to remain on their own private insurance, so the government developed the Medicare Program to help with costs. There are four primary parts to Medicare that can be individually selected:

Medicare Part A

So long as you or your spouse has worked for 10 years and paid the Medicare Tax (FICA), Medicare Part A is provided at no additional cost. Part A covers most emergency expenses such as inpatient hospital care, skilled nursing, and in home hospice care. There are other expenses that may be partially covered, but Part A is designed to cover short term emergency expenses. Long term care is not covered under traditional Medicare and total costs can be substantial so verify you have sufficient assets to self-insure or consider long term care insurance.

Medicare Part B

Part B covers preventative services and most medical treatments along with ambulance costs and mental health services. Coverage comes with a monthly premium that is based off income from two-years prior. A request can be submitted to use a more current years income if there has been an eligible life changing event (retirement being the most often checked box). That form can be found here. Submitting this form can save hundreds on monthly premiums. If income has substantially declined, it’s worth spending the time to verify your new income is reflected for Medicare premium purposes.

Medicare Part D

Medicare Part D covers all or part of the cost for prescription drugs. Like Part B, it comes with a monthly premium that is income based. Part D can be offered through Medicare Part C (Medicare Advantage Plans), so be cautious when reviewing options to avoid doubling your costs.

Medicare Part C

There’s a reason Part C is coming after A, B and D. Medicare Part C is not included in the “Traditional Medicare Program.” These plans are offered by Medicare approved private companies for those who are already enrolled in Part A and B. Part C offers additional coverage along with the potential addition of vision, dental, and hearing. Monthly costs will vary based on providers and coverage, but the main differentiator for overall cost comes down to whether or not your medical professionals participate in the program.

Medigap

Medigap (similarly to Medicare Part C) is not an offering through the Traditional Medicare program. It is offered through private insurance agencies as a way to buy additional coverage not available through Part A, B and D. These policies are primarily meant to reimburse deductibles and copayments but come with an added monthly premium cost. Additionally, Medigap policies cannot be used with Medicare Part C and must be carefully coordinated with other parts of the Medicare program to be effective. Those anticipating higher healthcare costs may want to consider a Medigap policy.

Enrollment

There is a seven-month enrollment window for Medicare. Three months leading up to your birth month, your birth month, and three months after your birth month. As Part A does not have a monthly premium, it is often advised (and sometimes required) to sign up for it when first eligible, even if coverage is being provided by an employer or spouses employer. Part B and D come with monthly premiums so enrollment can be delayed until employer provided coverage ends. Be careful with timing of enrollment in Part B and D. If deadlines are missed, penalties are applied to every future premium. More information and online enrollment can be found here.

If you’re receiving Social Security benefits by the time you turn 65, you’re automatically enrolled in Part A and B. Premiums can be deducted directly from your monthly Social Security benefit, so be prepared for reduced income around that time.

Conclusion

The Medicare program is complex and ever changing. Each individual has different needs for healthcare and differing abilities to pay the costs. Don’t simply ask your neighbor what plans they’re enrolled in as you may quickly learn their needs differ from your own. While Medicare options can be changed after initial enrollment, there can be higher costs and fewer available options. Get it right the first time so you can enjoy the retirement you’ve worked for without uncertainty in your healthcare options.

Want to know if a specific service or procedure is covered? Use Medicare's coverage tool.

|

Comments

Market Knowledge

Read the Blog

Gather insight from some of the industry's top thought leaders on Exchange Capital's team.

Exchange Capital Management, Inc.

110 Miller Ave. First Floor

Ann Arbor, MI 48104

(734) 761-6500

info@exchangecapital.com