How to Conduct Basic Advisor Due Diligence in 15 Minutes (or Less)

At last count, there were 629,848 individuals registered to sell securities or give investment advice in the United States. That number roughly corresponds to the population of every man, woman, and child in a city the size of Baltimore or Detroit. Even if only one quarter of one percent (0.25%) are bad apples, that means there are still almost 1,600 "advisors" you probably don't want anywhere near your accounts or the accounts of the people you love.

According to industry statistics, every 4 years, somewhere between one quarter and one third of financial advisors leave the industry for good and a nearly identical number of new recruits comes into the business. Add to that the number of people jumping from one firm to another or moving from one regional branch to another and it’s a good bet that sooner or later you’ll either be in the market for a new investment advisor or find your accounts have suddenly been assigned to someone you’ve never met.

As the senior partner of a boutique registered investment advisory firm, I’ve interviewed hundreds of candidates for investment advisory positions over the last 30 years. As our firm’s Chief Compliance Officer, I’ve also learned a thing or two about where some of the most revealing information is hiding in plain sight among the standard regulatory documents. Information that anyone with a computer and a little know-how can uncover in 15 minutes or less.

Trust...But Verify

Let’s face it, when it comes to deciding who you’re going to trust help manage your family’s nest egg there’s a lot at stake. Unlike a medical doctor, lawyer, or professional engineer where there are well established educational and training criteria required to obtain a license to practice, the financial service industry has virtually no barriers to entry. Other than being 18 years of age and passing at least one licensing exam, there is no educational or experience required to start working in the financial service industry. You don’t even need a high school diploma or a GED.

Of course the vast majority of financial professionals are both skilled and ethical practitioners. But like you, I want to quickly explore five core attributes that yield important details about every candidate:

- How long have you been in the industry?

- Where have you worked?

- Are there any complaints, disclosure events, or sanctions in your file?

- How have you been compensated?

- What degrees, licenses or professional designations have you earned?

Here’s how to get started.

Step 1: BrokerCheck - Figuring Out Who's Who

FINRA’s BrokerCheck website ought to be ground zero for starting any due diligence work. The Financial Industry Regulatory Authority, Inc. (FINRA) is a private corporation that acts as a self-regulatory organization for securities dealers and their registered representatives. To get started, simply enter in the name of your broker or advisor.

Pro Tip: Including the name of the firm where he or she works will cut down on the number of files the search query returns.

Right away, the tile with your advisor’s file contains visual clues that yield important information. A light blue circle with a “B” indicates the advisor is a Broker who is regulated by FINRA. A dark blue circle with an “IA” indicates a registered investment advisor. Large and medium sized investment advisors (those managing assets greater than $100MM) are regulated by the U.S. Securities & Exchange Commission while small and start-up investment advisors are regulated by the state bureau where the investment advisor’s principal office is located.

If your advisor is either a broker or a dually registered hybrid, clicking on the light blue “B” will flip the tile to reveal a screen that shows employment history as a broker, security licenses held, and any serious disclosure events.

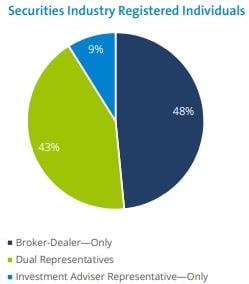

In general, brokers are compensated by commissions tied to transactions or by sales and redemption charges associated with financial products (proprietary mutual funds, insurance, annuities, etc.) while investment advisors are compensated by a management fee (fixed fee, hourly charges, or a percent of assets managed). Tiles that contain both circles are dually registered “Hybrids” who are sometimes compensated by commission and sometimes compensated by fees.

Pro Tip: An investment advisor is a fiduciary. If your financial professional is a dually registered hybrid, be sure to ask how you will know when they are acting as a broker and when they are acting as an investment advisor.

Step 2: SEC Filings

Clicking on the dark blue “IA” circle will flip the tile and offer you the opportunity to be redirected to the U.S. Securities & Exchange Commission’s Investment Advisor Public Disclosure website. Unlike FINRA which is an industry self-regulatory organization, the SEC is an agency of the federal government.

Pro Tip: Before you leave BrokerCheck, jot down your investment advisor’s individual CRD (Central Registration Depository) number. Then when you navigate to the SEC website, record the firm’s IARD (Investment Advisor Registration Depository) number. You’ll need both.

To investigate an individual investment advisor representative, toggle to the tab marked “Individual” and enter your advisor’s CRD number. The site will return an option to view or download a detailed report.

To conduct proper due diligence of a firm, toggle to the tab marked “firm” and enter the firm’s IARD number. You’ll then have an options to view the latest Form ADV filed or the Part 2 Brochures. Form ADV contains critical disclosure information concerning the advisory firm as a whole. While the form itself can run 15 or more pages, it contains a treasure trove of information. You’ll be able to see:

- The firm’s reporting status (Item 1)

- Where the firm conducts business and who regulates the firm (Item 2)

- The kinds of clients served and how much the firm manages (Item 5)

- Other business activities that could create conflict of interest (Item 6)

- Financial industry affiliations (Item 7)

- Disclosure of any regulatory events that could be cause for concern (Item 11)

- Direct owners and executive officers (Schedule A)

Selecting the button marked “Part 2 Brochures” directs you to a copy of ADV Part 2A. Do not overlook this form...it's a plain English narrative that spells out exactly how your advisor is compensated, the kinds of services performed, and the specific methods of analysis. ADV Part 2B is a written narrative that contains detailed information regarding each of the firm’s investment advisor representatives. This includes employment history, educational background, and any licenses or professional designations earned or maintained.

Pro Tip: Be aware of "closet" hybrid advisors. Some SEC registered investment advisors have separate but affiliated insurance agencies that also sell annuities and insurance products. These disclosures will appear under "Other Business Activities" on Form ADV. Investment Advisors with affiliated insurance operations generally do not show up as dually registered (hybrid) firms on FINRA's BrokerCheck.

Step 3: Professional Designations - Sorting Wheat from Chaff

These days it seems nearly everyone is a chartered, certified, registered, or fellow of one sanctioning body or another. The proliferation of financial service designations is frequently bewildering. I’m not going to attempt to rank order any of the certifications in terms of what I personally might think is best, but I will tell you what we look for when making qualitative assessments of a designation. For us at Exchange Capital Management, it boils down to three simple elements that all signal intent to make investment management and financial planning a career:

- Does the designation require a 4 year college degree?

- Is there a rigorous multi-year preparation, testing, and work experience requirement?

- Once the designation has been earned, is there a continuing education component?

Last but not least, ask yourself how well the designation relates to the specific job to be done. I have tremendous respect for CPAs, and the designation certainly meets all three of the criteria listed above. But our practice is laser focused on wealth management and that means making informed investment management (think CFA type skills) and financial planning (think CFP type skills) choices in the presence of taxes. While that requires us to frequently collaborate with our client’s tax advisors, it doesn’t mean we need to be able to recite the internal revenue code chapter and verse. In a similar way, risk management is a critical element of any comprehensive financial plan. But navigating around the complexities of specific insurance policies may require the services of a Chartered Life Underwriter (CLU) or a Chartered Property & Casualty Underwriter (CPCU). Remember, even a highly regarded professional designation isn't universally applicable to the job you need done.

Pro Tip: Anytime you see a professional designation associated with an individual financial professional, be sure to cross-check with the sanctioning body to verify your advisor's credentials are both legitimate and in good standing.

Vigilance is the Antidote for Regret

If there's one thing I get asked with some regularity it's "how often should I go back and check-up on my advisor?" My response to this query is nothing but consistent: you should go through this process before you engage a new advisor, anytime there has been a change in the pattern of behavior from your advisor (or the firm that employs your advisor), anytime someone new is being introduced to your "team" of advisors, and always at least annually. If you find anything that doesn't seem quite right...ask about it. Immediately. High caliber advisors will never be offended (and probably can't wait to answer your questions). I know I won't.

Michael Reid, CFA is Exchange Capital Management, Inc.'s Chief Compliance Officer and a Managing Director. His CRD Number is 1103910. Exchange Capital's IARD Number is 1048.

Comments

Market Knowledge

Read the Blog

Gather insight from some of the industry's top thought leaders on Exchange Capital's team.

Exchange Capital Management, Inc.

110 Miller Ave. First Floor

Ann Arbor, MI 48104

(734) 761-6500

info@exchangecapital.com