Helping Your (Somewhat) Adult Child Transition to the Workforce

%20Adult%20Child%20Transition%20To%20The%20Workforce%20-%20Moneygirl%20(Color)%20-%208-4-2020.png?width=1600&name=Blog%20Image%20-%20Nate%20-%20Helping%20Your%20(somewhat)%20Adult%20Child%20Transition%20To%20The%20Workforce%20-%20Moneygirl%20(Color)%20-%208-4-2020.png) Your child's transition from naive college undergrad to working professional is rougher than a cross-country flight in front of a toddler who has recently discovered the art of kicking. Gone are the days of skipping class to sleep, of weekends beginning promptly at 2:30 p.m. on Thursday. No longer can they count on their buddy to have the answers to the Econ problem set. If college is the kiddie pool of independence, then full-time employment is the deep end without a lifeguard. Grades disappear, and questions no longer have straight-forward solutions. The binary, structured solution world of education disappears. The answers are no longer in the back of the book. All that without even considering the mountain of student debt that can come attached to that long sought-after degree.

Your child's transition from naive college undergrad to working professional is rougher than a cross-country flight in front of a toddler who has recently discovered the art of kicking. Gone are the days of skipping class to sleep, of weekends beginning promptly at 2:30 p.m. on Thursday. No longer can they count on their buddy to have the answers to the Econ problem set. If college is the kiddie pool of independence, then full-time employment is the deep end without a lifeguard. Grades disappear, and questions no longer have straight-forward solutions. The binary, structured solution world of education disappears. The answers are no longer in the back of the book. All that without even considering the mountain of student debt that can come attached to that long sought-after degree.

You’re understandably concerned about your child’s transition. When your child comes to you for help (perhaps for the first time since middle school), you want to make sure you give him/her useful advice while focusing on the highlights. Time is of the essence, and rather than wade through all the savings tips and tricks out there, we’ll discuss the most critical talking points to discuss with your child.

Benefits of starting early:

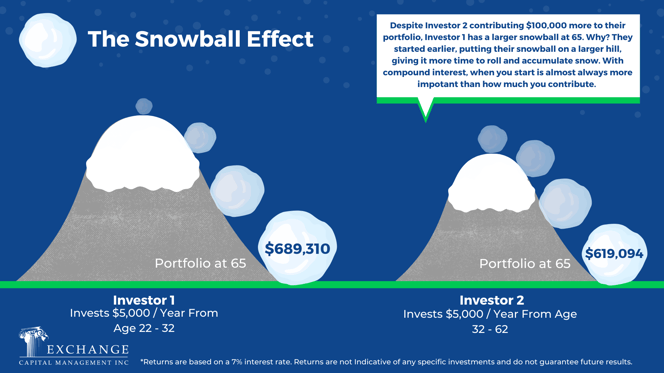

If your child's attention span is not what it used to be after a decade of social media use and you can only get ONE point across, make it this one: START EARLY! On the surface this appears obvious. Of course saving more is good for me Mom, everyone knows that. What people underestimate is just how much of an advantage it can be. Lets look at a simple example that will drive the point home.

Say you're given two savings paths to choose from. The first path has you starting at age 22 and investing $5,000 per year for ten years, then nothing after that. The second path doesn't get started until age 32, when you begin investing $5,000 per year for 30 years. On the surface, it appears the second path makes more sense. After all, you're putting aside an additional $100,000! No need to start saving now, you can always make up for it later. Except... it turns out to be false. Assuming an annual rate of return of 7%, the first option results in $50,000 additional savings, despite investing a third of option two. How can this be? The power of compound investing- wherein the 7% rate of return not only goes to work on the principal investment, but the earnings as well. Put another way, you’re earning money on your earnings. This is referred to as the snowball effect, and starting early puts your snowball on a much higher hill, allowing it to gain more momentum.

Except... it turns out to be false. Assuming an annual rate of return of 7%, the first option results in $50,000 additional savings, despite investing a third of option two. How can this be? The power of compound investing- wherein the 7% rate of return not only goes to work on the principal investment, but the earnings as well. Put another way, you’re earning money on your earnings. This is referred to as the snowball effect, and starting early puts your snowball on a much higher hill, allowing it to gain more momentum.

I was able to convince my kid to start saving early. How can they start saving to take advantage of that "compound investing" thing?

Let's pump the breaks just a little bit. Compound investing works its magic in a long-term approach - if you want to take full advantage of compound investing, you need to put the money away for awhile. Your child's retirement is certainly a ways away, but not all their financial needs will be on this long-term horizon. What if disaster strikes out of nowhere (see: 2020)? Before even considering investing for the long-term, it is critical to lock down a cash reserve for emergencies.

Three-to-six months of living expenses is the standard amount to hold in cash. Checking account, savings account, online savings account - it does not matter. As long as your child can access the funds at a moment's notice, it is an acceptable place to hold cash.

Okay, I told them to keep cash reserves on hand. Now, can you tell me how take advantage of "compound investing"?

Employer retirement accounts are an excellent starting point for a new saver with a long time horizon. Contributions automatically come out of their paycheck, eliminating the need to physically sit down and put money away. Reducing the number of steps needed to save is a great way of fostering a strong savings habit.

Your child's workplace retirement account will likely be a 401(k), 403(b), or SIMPLE IRA. The mechanics behind each vary slightly, but they share the same purpose: a place to put tax-deferred money for use in retirement. Money deposited into any of these accounts is tax-deferred, meaning the owner will not pay taxes on contributions or earnings until they make a withdrawal. While possible to take money out before retirement, restrictions are put in place to disincentivize an individual from doing so. Limited access to your funds is the trade-off for the beneficial tax treatment.

On top of providing a tax-deferred savings vehicle, many employers offer additional incentives to encourage employee savings. It is common practice to offer a "match", or an employer contribution to the employee's individual retirement account. Typically, employees are required to make some level of contribution before the employer contributes. Generosity has it limits, and employers usually cap their contributions between 3-6% of salary, regardless of how much the employee contributes. Employee matches should be viewed as "free money" as it cost you nothing for employers to contribute.

Everyone's budget allotment for savings is different. If your child only has limited resources, you should encourage them to make the employer match a priority. Of course, this is all predicated on your child establishing a reserve fund first.

Earning the employer match should be the minimum contribution, got it. But should they be saving more?

Saving more is usually a great idea, but it may not be optimal given your child's life circumstances. If your child carries student debt with high interest rate, it may make sense to put extra cash towards the debt rather than a retirement account. A simple rule of thumb for paying down debt vs investing is to compare the debt’s after-tax interest rate to the rate of return you might expect from your investments. If the debt’s interest rate is lower than the investment’s expected rate of return, then prioritizing investing makes sense. If the numbers are close, the matter becomes one of personal preference and talking to a professional can help you balance the choices. There are no guarantees in the stock market, so why not pay down a liability that you KNOW has a consistent cost? By paying down debt, you are able to control the return you get on your money.

No one budgets perfectly the first time. Your child may have less ability to save money than originally anticipated. If they're struggling to pay bills on time, they should not be afraid to cut back on investing. Don't lose sight of immediate expenses.

My child has budgeting down and even managed to carve out some extra cash. Should they increase their employer contributions?

Certainly! No shame in continuing to pump money into that tax-deferred nest egg. However, you should mention that it is worth considering other options (assuming they have earned their employer match), specifically the Roth IRA. The biggest difference between the two is how each are taxed. As opposed to your employer plan accepting pre-tax dollars, the Roth IRA accepts post-tax dollars. What this means for a Roth IRA owner is the money is never taxed again. Not when it grows, not when you take it out, never. Like the employer plan, there are restrictions with the Roth IRA on when you can pull money, and if you break them you may be subject to fees. These limits make the Roth IRA a bad vehicle to store emergency funds, but aren't as problematic if the goal is long-term.

The Roth IRA has a critical requirement: if you're single and make more than $139,000, you are ineligible to contribute (the limit is higher if you're married). It is important to contribute to a Roth IRA while your child is on an entry level salary, because as all those promotions come piling in, your child may be ineligible before they know it.

Welcome to the Deep End

After setting (and sticking to) a budget, establishing an emergency fund, and contributing to an employer fund, your child is well on their way to fame and fortune (or a steady and stable life with manageable ups and downs). However, we only scratched the surface of the challenges facing your fresh-faced graduate. They’ll probably have about a million questions… I know I did. When their queries dig deeper than surface level - looking for specifics in investing, the markets, and savings strategies - it’s time to reach out to your advisor. A great advisor will be happy to review your child’s circumstances and help them take the right steps. After all, you pay them to have these answers. This will save you more of your valuable time, allowing you to spend it kicking back on the boat with your suddenly-not-so-youngster.

Nate Pruitt is a Financial Planning Specialist at Exchange Capital Management. The opinions expressed in this article are his own.

Nate Pruitt is a Financial Planning Specialist at Exchange Capital Management. The opinions expressed in this article are his own.

Comments

Market Knowledge

Read the Blog

Gather insight from some of the industry's top thought leaders on Exchange Capital's team.

Exchange Capital Management, Inc.

110 Miller Ave. First Floor

Ann Arbor, MI 48104

(734) 761-6500

info@exchangecapital.com