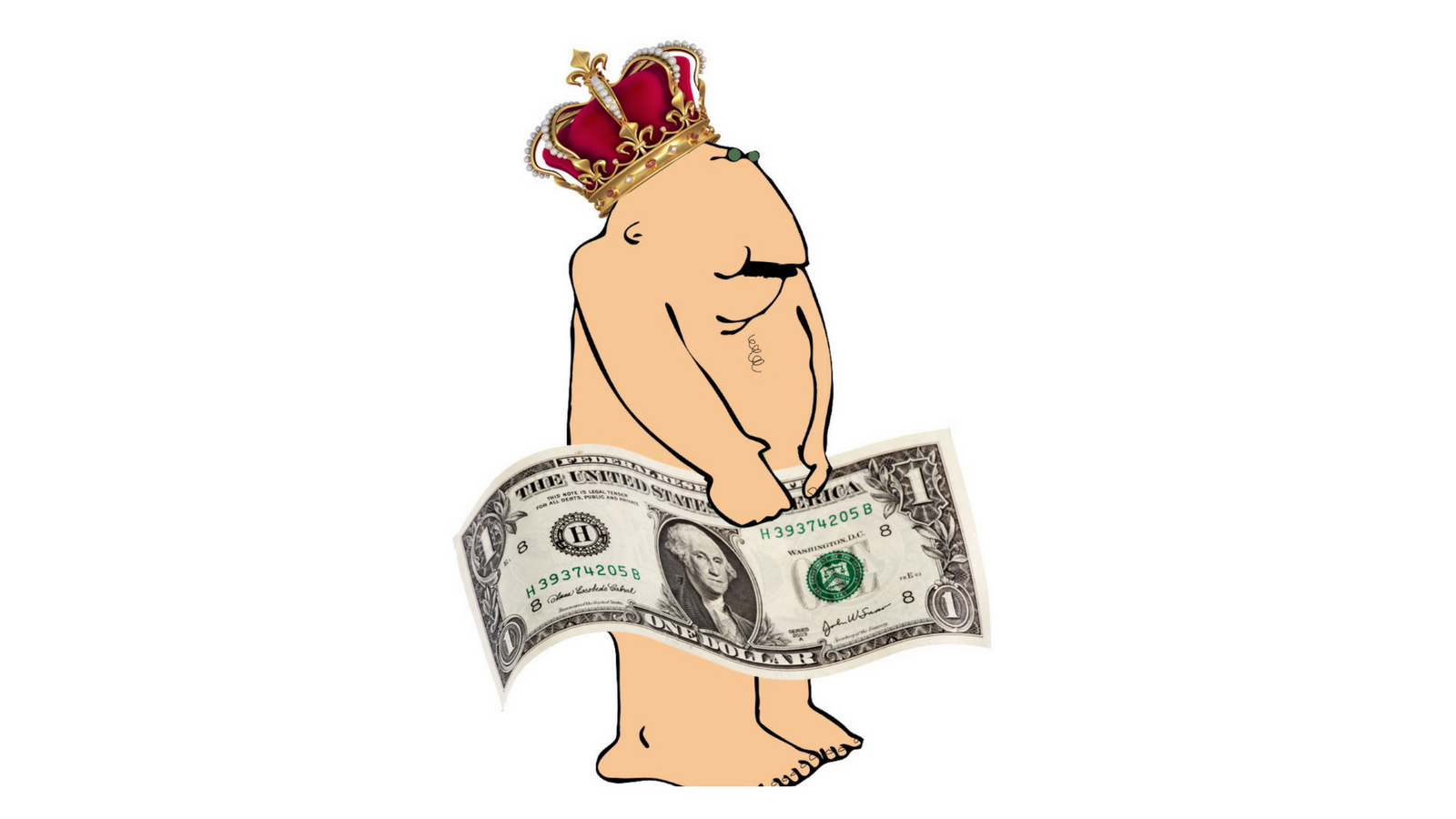

Hedging Bets on the Emperor's Change of Clothes

The wily tailors out peddling “sophisticated” hedge fund garments to the elite classes of pension fund royalty were put on notice that some of their most expensive and profitable financial clothing lines are leaving their best customers feeling a little, well…exposed. Individual investors should take heed.

Citing concerns that hedge fund investments have become too complicated and too expensive, the California State Public Employee Retirement System, better known by its acronym CalPERS, announced they would be liquidating their entire $4 billion hedge fund portfolio and curtailing all future investment activity in this corner of the alternative asset class universe.

Charged with the fiduciary responsibility to oversee pension and health care benefits for nearly 1.7 million retired and disabled state employees, CalPERS oversees some $300 billion of investments in stocks, bonds, and real estate. Over the years, the mammoth state agency has cultivated a reputation for being both an innovative investment pioneer and a sophisticated thought leader. The reputation is well deserved.

By itself, CalPERS decision to divest is unlikely to put much of a dent in the colossal hedge fund industry, now estimated to control assets in excess of $2.8 trillion. The conclusion by CalPERS board of governors that hedge fund investments simply aren’t earning their keep on a risk adjusted basis could be viewed as something of a watershed event however. After five consecutive years of anemic performance where hedge fund returns failed to keep pace with the S&P 500, the allure of an investment class sporting a fee structure of 2% plus a 20% share of the paltry gains has become a bit threadbare. If and when other pension sponsors or major foundations conclude their hedge fund garments are feeling a little too breezy despite inevitable protestation from hedge fund promoters about how handsomely the clothes fit, a small trickle of net outflows could turn into a torrent.

So why should ordinary investors care what CalPERS or the Bill & Melinda Gates Foundation for that matter is doing in the now tarnished hedge fund arena? It boils down to trend spotting. As almost everyone knows, hedge funds often set minimum investment amounts at $1 million or more and impose significant lock-up periods that pinch liquidity. With this structure, it’s not typical for most individuals to invest directly in hedge fund strategies or even a fund of funds. What’s worth paying attention to is whether or not the CalPERS lead gathers any steam among institutional peers. Should that occur, the forced unwinding of a number of highly leveraged hedge funds could trigger the sale of a significant overhanging supply of securities that suddenly needs to find a new home.

Under those conditions, prices at least temporarily would tend to gap down. Believe it or not, that could be tremendous news for investors looking to put new cash to work in a market that’s been steadily elevated by a recovering economy and surging corporate profits. As any seasoned clothes horse knows, its always good to refurbish your investment wardrobe off the discount rack.

Michael Reid, CFA is a Managing Director and Partner at Exchange Capital Management. The opinions expressed in this article are his own.

Comments

Market Knowledge

Read the Blog

Gather insight from some of the industry's top thought leaders on Exchange Capital's team.

Exchange Capital Management, Inc.

110 Miller Ave. First Floor

Ann Arbor, MI 48104

(734) 761-6500

info@exchangecapital.com