De-Risking As You Age: What Does it Mean, and Do I Need To Do It?

%20-%206-9-2020.png?width=1600&name=Image%20-%20Blog%20Image%20-%20Matt%20-%20Derisking%20as%20You%20Age%20-%20Pillows%20(colored)%20-%206-9-2020.png) As we find ourselves in the midst of this global pandemic, many of us have watched our's and our neighbor's financial lives get upended. Lost jobs, dwindling savings accounts or declining investment accounts have provided a stark reminder of the financial risks we constantly face, and all too often ignore. For those of us who are approaching or are in retirement, a deeper fear has crept in; fear that retirement may need to be postponed or even worse that current savings may not outlast retirement. How do we alleviate that fear? The simple answer is to de-risk.

As we find ourselves in the midst of this global pandemic, many of us have watched our's and our neighbor's financial lives get upended. Lost jobs, dwindling savings accounts or declining investment accounts have provided a stark reminder of the financial risks we constantly face, and all too often ignore. For those of us who are approaching or are in retirement, a deeper fear has crept in; fear that retirement may need to be postponed or even worse that current savings may not outlast retirement. How do we alleviate that fear? The simple answer is to de-risk.

We all have fond memories of playing skee ball at the arcade. As you probably remember, there were two types of players, those that played it safe, rolling it right down the middle every time, and those whose eyes darted right for 100 point pocket tucked neatly in the corner. Those risky few didn’t hit that 100 pocket often, but boy when they did, the tickets flowed.

If we are being honest with ourselves, the way we approached skee ball as kids mirrors the way we approach risk in our daily lives, and our attitude towards investing within our retirement portfolio. Risk assessment and mitigation is central to investing and ensuring we accumulate enough assets to meet our retirement goals. However, just like in skee ball, not every person is the same. The same de-risking strategy may not apply to everybody, even with retirement right around the corner.

The Folly of The One-Size-Fits-All Target Date Fund

At a high level, there are two stages of retirement investing, accumulation and decumulation. During the accumulation stage, we stash away as much money as possible in assets we expect to grow. The decumulation stage begins in retirement, where we start withdrawing that hard earned money so we can do the things we dreamt of while stuck in the office all those years. However, there is an important yet seldom discussed in-between stage that is referred to as the transition stage. This stage is when you begin transitioning your portfolio from the growth securities to safer, more stable investments, such as bonds.

The common financial planning advice is that during this transition stage we should de-risk our portfolios as we approach retirement. What exactly is the ideal pre-retirement de-risking strategy? Ask the big mutual fund companies and they will tell you they have found the magic formula, which they bundle into their Target Date/Lifepath funds. Only one problem with that; they found one strategy, and only one strategy that gets applied equally to every single person invested in the fund regardless of any other investment factor. This answer is a systematic de-risking strategy that transitions from stocks to bonds over a 25 year period ending on a pre-determined date that is supposed to correspond with the investor's retirement date. Great, but as we have undoubtedly learned in life, a one-size-fits-all approach isn't always the best answer.

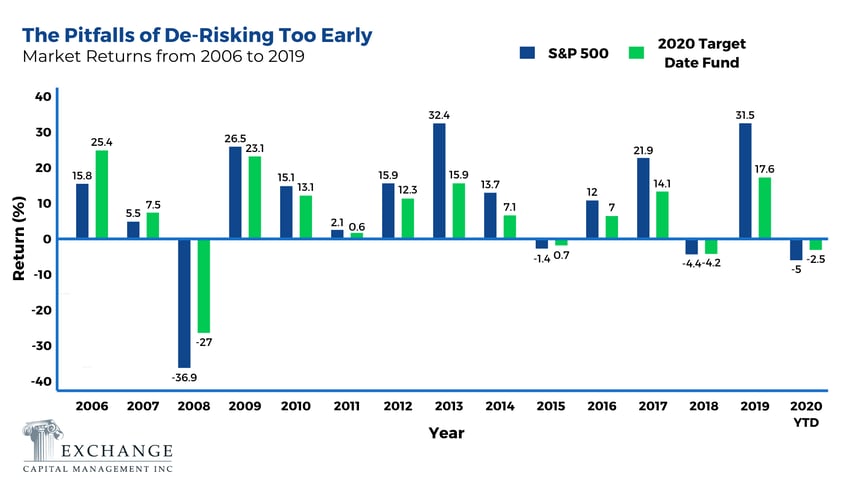

To illustrate this more vividly with a real world example: if an individual retiring this year followed the target date retirement fund strategy, they would have begun de-risking 25 years ago right before the Tech boom. Sure, they would have weathered the Great Recession better than most; but they would have slowly and steadily taken money off the table during one of the biggest and longest bull markets in history. Here are the cold hard facts: from 2006 through May 2020, the S&P 500 returned approximately 221% or about 8.7% per year vs a 2020 target date fund which, due to de-risking, returned approximately 136% or 6.3% per year. Put another way, a $10,000 all equity portfolio today would be worth $22,100 and the target date fund starting with the same amount would be worth $13,600. Extrapolate those numbers some and it quickly becomes clear that there is a lot of hard earned money being left on the table.

Here are the cold hard facts: from 2006 through May 2020, the S&P 500 returned approximately 221% or about 8.7% per year vs a 2020 target date fund which, due to de-risking, returned approximately 136% or 6.3% per year. Put another way, a $10,000 all equity portfolio today would be worth $22,100 and the target date fund starting with the same amount would be worth $13,600. Extrapolate those numbers some and it quickly becomes clear that there is a lot of hard earned money being left on the table.

De-Risking for Various Reasons

Maybe the target date retirement fund approach works for some extremely risk-averse investors, but it hardly makes sense for others. In other words, not every investor is the same, with the same risk profile or financial needs. Some people need to consider de-risking their portfolios due to financial constraints. Perhaps they started investing late, or due to location, family commitments, or lifestyle desires and decisions, they have less money in their retirement accounts than they want or need. Some need to consider it due to emotional reasons and their risk appetite. These people might be okay missing out on some of the market gains because they just can't stomach that 30% market drop. Finally, some people have no need to de-risk at all. They did all the right things: started investing early, saved more than they spent, accumulated as much as they could and, through some fortunate events, now find themselves with more money for retirement than they could possibly need.

Build a Financial Plan

The best way to answer whether de-risking is something you should consider is to build a detailed financial plan. Ask the hard questions, gather all your financial information and put together a plan that works for you. What life-stage are you in, how close to retirement are you, when do you plan to retire? What is my desired lifestyle? What is the value of all my retirement assets and can they sustain my desired retirement lifestyle? Do I have a pension, what will my social security benefits look like? What are my current assets vs. liabilities? What is my risk appetite? If the market drops 10%, 20% or even 30% -- can I stomach that or will I panic and sell everything? If a drop like that happens, will it change the lifestyle I am able to live?

These questions can quickly lead to feeling overwhelmed. There is much fear and anxiety around having enough money to retire and making sure it lasts throughout retirement. Think of it this way, as you get older and medical problems arise, how many of you try to handle those many challenges alone, without a doctor? Why then would you not take the same approach with your finances. Much like in medicine, a one-size-fits-all approach just doesn't work. Lessen your burden and reduce your anxiety. Come in and let our team at Exchange Capital Management help you grow and protect your wealth with a personalized financial plan that lets you live your best life up to and through retirement.

Matt Farris, is a Trader at Exchange Capital Management. The opinions expressed in this article are his own.

Comments

Market Knowledge

Read the Blog

Gather insight from some of the industry's top thought leaders on Exchange Capital's team.

Exchange Capital Management, Inc.

110 Miller Ave. First Floor

Ann Arbor, MI 48104

(734) 761-6500

info@exchangecapital.com