Can You Live the Life You Want Without Worrying About Money?

.png?width=1600&name=Blog%20Extras%20(2).png)

Coming soon to a commercial break near you, is a new advertising campaign from the CFP Board that aims to shed light on the higher emotional well-being consumers achieve when engaging with a certified financial planner. You may have seen their previous T.V. spot from a couple of years ago which featured a professional DJ throwing on a suit and convincing prospective clients that he was a trustworthy financial advisor.

That campaign slogan was “if they’re not a CFP pro, you just don’t know.” It was a clever public service announcement pointing to something we’ve written about here before - the importance of understanding where your financial advice is coming from, and whether or not it’s in your best interest.

The latest promotion pivots from pointing out the danger of working with just any “advisor,” to showcasing the potential benefits of engaging in financial planning work. Yet, what seems to get glossed over in all of the excitement to spread the word, as often happens when advisors attempt to describe their services, is a good explanation of what exactly financial planning is in the first place.

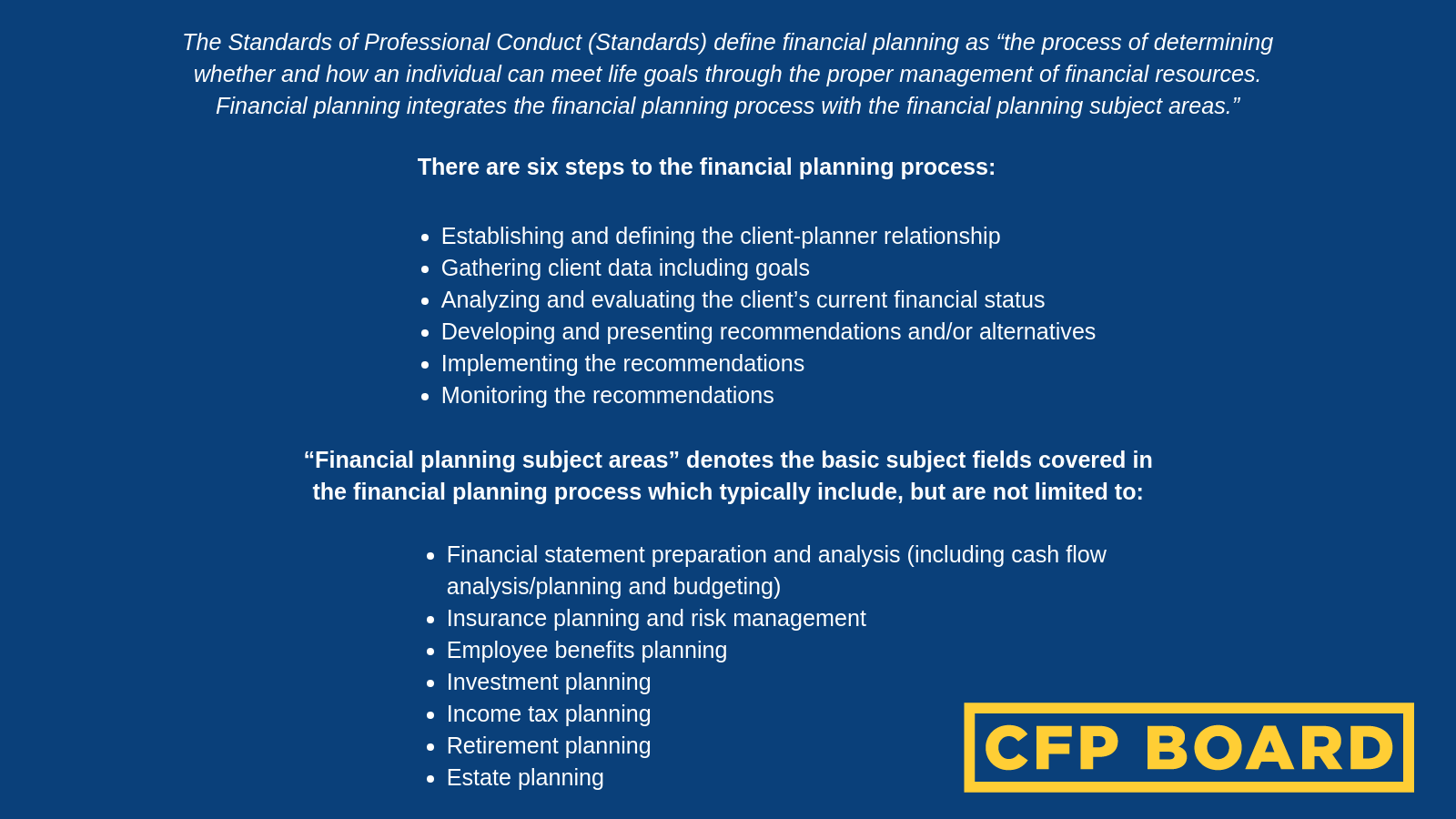

The reason for that may be because it’s hard to narrow down an explanation of something that if done properly, is more of an ongoing and evolving process that really never ends. The CFP Board attempts to define financial planning as the following:

Rolls right off the tongue doesn’t it? Any time you need 2 separate sets of bullet points to explain something, you’re going to scare some people away. Google search financial planning for a simpler definition, and you’ll find a lot more of the same (or worse!) unfortunately. Investopedia, a site aimed at helping consumers better understand complex financial topics, takes a crack at it and here’s what they came up with:

"A financial plan is a comprehensive evaluation of an investor's current and future financial state by using currently known variables to predict future cash flows, asset values and withdrawal plans. Most individuals work in conjunction with a financial planner and use current net worth, tax liabilities, asset allocation, and future retirement and estate plans in developing financial plans. These metrics are used along with estimates of asset growth to determine if a person's financial goals can be met in the future, or what steps need to be taken to ensure that they are."

Eh, on second thought, maybe the bullet points weren’t so bad after all. Anyone else get lost somewhere between cash flows and asset allocation?

The shame is, financial planning can be explained in a much simpler manner when it's posed instead as a question:

Can I live the life I want without worrying about money?

I believe that's what most of us are after in the end, and would love to have a path to follow to get there. Money is a necessary part of our lives, and it shouldn't be something that adds to our levels of stress.

That's not to say that financial planning means never again having to think about where our money is being spent or how it needs to work for us going forward. It’s all about instilling the confidence that you’re taking the necessary steps to ensure you can do what you want to do with your money.

Unfortunately, that’s easier said than done because we tend to worry about the wrong things when we invest.

Beating the market (whatever that means), picking the year’s hottest stock, or timing the next “crash” are all great war stories to share at dinner parties. But any of those feats likely don’t mean anything if they aren’t in service to a plan. They are pure speculation instead, and likely won't help you worry less about money. In fact, the opposite is likely true, as belief that you can do it again leads to more and more emotional decision making.

Financial planning forces us to move past focusing on uncontrollable variables and instead results in rational and thoughtful behavior from both investors and advisors. It should produce a disciplined investment portfolio that can deliver what the plan deems a success, rather than anchoring on random benchmark returns that mean nothing on their own.

Ever evolving assumptions and calculations that change as your life changes will guide decision making reaching well beyond just investing. As the CFP Board suggests, there should be coordination between other critical planning areas such as insurance planning, employee benefits planning, tax planning, retirement planning, and estate planning to name a few.

With a proper financial plan in place that is regularly revisited and updated, you shouldn't have to worry about whether or not your money will allow you to live the life you want. For a better understanding of what financial planning is and why it's key to a long term, worry-free relationship with money check out our infographic below.

Comments

Market Knowledge

Read the Blog

Gather insight from some of the industry's top thought leaders on Exchange Capital's team.

Exchange Capital Management, Inc.

110 Miller Ave. First Floor

Ann Arbor, MI 48104

(734) 761-6500

info@exchangecapital.com