A MEGA Roth Savings Opportunity Hiding Within Your 401(k)

Looking to enhance your retirement savings beyond maxing out contributions to your employer provided retirement account? Hidden deep within your 401(k) plan rules, may be an opportunity to take advantage of one of the best strategies to come along in years. It’s been dubbed the "Mega Backdoor Roth," and with a name like that, it has to be good, right?

The MEGA

The Mega Backdoor Roth strategy is still relatively new and has flown somewhat under the radar, even within the financial planning industry. However, it's quietly becoming more widely available as people are learning of its key benefit - the ability to contribute up to $37,500 into a Roth IRA every year. That's over 6 times the annual Roth IRA contribution limit of $6,000 ($7,000 if over age 50)! Not to mention, there's no income restrictions, which keep many high income earners from utilizing Roth IRAs, and the IRS has explicitly ruled that it’s an acceptable procedure.

Sound too good to be true? It may be, as not everyone has access to this strategy. But if you’re one of the lucky ones who does, there really is no better way to tuck away such a large amount of additional tax advantaged retirement savings. (A Health Savings Account, or HSA, is also a great option to explore which we’ve written about here before).

A little background before getting into the details of how the Mega Backdoor Roth works.

Backdoor Roth Sound Familiar?

Perhaps "Backdoor Roth" is a term you’ve heard of before. It's a loophole that allows high income earners to contribute to Roth IRA's despite the income phase-out mentioned above.

Here's how it works:

If you earn more than $139,000, or $206,000 as a couple, you contribute to a traditional, nondeductible IRA instead of a Roth IRA. Then you immediately convert the money in the traditional IRA to a Roth IRA with no tax consequences since there were no earnings on the contribution you just made.

Good But Not Great

While it can be a good strategy for high income earners to take advantage of, the regular Backdoor Roth just isn’t as advantageous as the Mega for a few reasons:

- First, the regular Backdoor Roth strategy is capped by the $6,000/$7,000 annual contribution limits of Roth IRA's.

- Second, the conversion step of the regular Backdoor Roth strategy can generate a surprise tax liability if you own any other IRA (traditional, SEP, Simple) accounts beyond the one you are converting.

- Third, the “backdoor” loophole has long been rumored to be closed by Congress. While the new tax bill just made clear it's still allowed for now, it likely won’t be long before it comes up again.

Making the MEGA Happen

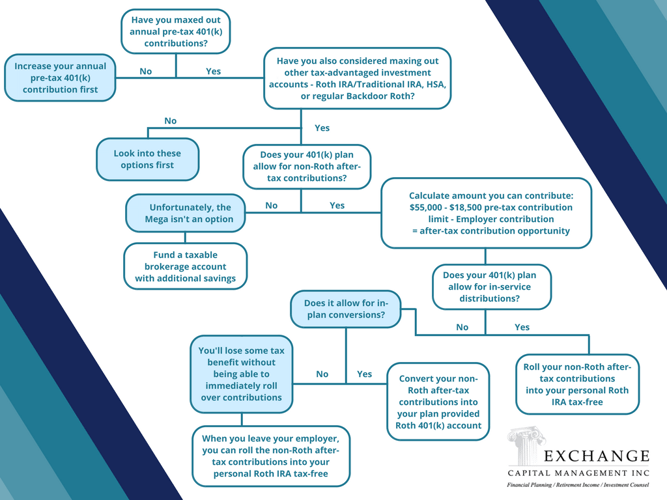

If you are already maxing out your 401(k) contributions ($19,500 pre-tax, annually), and are looking to save more than the $6,000/$7,000 you’re limited to with a Backdoor Roth, then you should look into a Mega Backdoor Roth. Unlike with the regular Backdoor Roth, the Mega is initiated through 401(k) plans instead of IRAs. In short, there are 2 steps:

- Make up to $37,500 in after-tax contributions into your 401(k) beyond the individual pre-tax contribution limit. (For example, the 2020 total 401(k) contribution limit is $57,000. If you contribute the individual pre-tax or post-tax Roth max of $19,500 and your employer doesn’t match with additional contributions, you can save any additional amount up to the $57,000 limit - in this case, allowing for up to $37,500 post-tax).

- Rollover your after-tax contribution amount into either your Roth 401(k) or Roth IRA.

Simple right? If only 401(k) plan administrators (and the IRS) made it that easy.

Rules, Rules, Rules

Unfortunately, there are two big road blocks that could be standing in your way.

- First, your 401(k) plan rules need to allow for non-Roth, after-tax contributions. Many plans now offer the option of making after-tax Roth 401(k) contributions, but you're looking for the ability to go beyond that with non-Roth, after-tax dollars. A large amount of plans won't allow this feature, but that may be beginning to change as companies look for new ways to enhance their employee benefits packages.

- Second, your 401(k) plan rules will need to allow for either in-plan Roth 401(k) conversions or in-service distributions (rollovers to an outside Roth IRA). Either of these moves are key in getting your post-tax contributions over into Roth accounts so they can enjoy tax-free growth right away. By converting immediately, you avoid taxes on earnings while also bypassing the $19,500 individual 401(k) contribution limit all at once.

All plans will vary when it comes to this conversion/distribution step. Some limit the number of times you can do it per year, others allow for an unlimited amount (each paycheck for example). This is important when it comes to implementing the strategy, but as long as it’s available at least once a year it will likely make sense.

Alternatively, even if these aren’t allowed, a Mega may still be worth looking into if you expect you may be leaving your company in the near future and will be able to roll over any after-tax contributions at that point.

A Select Few

Currently, many 401(k) plans aren’t set up to accommodate the Mega Backdoor Roth strategy. The IRS ruling that allows for the process only came out in 2014, so it’s not surprising given the relative infancy of the idea. Yet, a number of the largest companies in the country like Apple, Google, Microsoft, Ford, GM and Delta have moved to make it available, so we may see more begin to follow. Ask your 401(k) plan provider if it’s an option for you, and if it's not, be sure to check back in each year to see if it will be.

If all this sounds too good to be true, consider the fact that Congress might think so too. After all, politicians have a habit of acting to seal off loopholes before a trickle of savvy investors turns into a flood.

Editor's Note: The post was originally published in April 2018 and has been updated to represent current rules, regulations, and statistics. Latest update was in October 2020.

Comments

Market Knowledge

Read the Blog

Gather insight from some of the industry's top thought leaders on Exchange Capital's team.

Exchange Capital Management, Inc.

110 Miller Ave. First Floor

Ann Arbor, MI 48104

(734) 761-6500

info@exchangecapital.com