Dining at the Cafe 401(k)

Dining at the Cafe 401(k)

Oct 22, 2019

4

min read

The Hidden Cost of a Free Fund

The Hidden Cost of a Free Fund

Aug 13, 2019

4

min read

The Price is Right: Stock Buyback Edition

The Price is Right: Stock Buyback Edition

Apr 9, 2019

6

min read

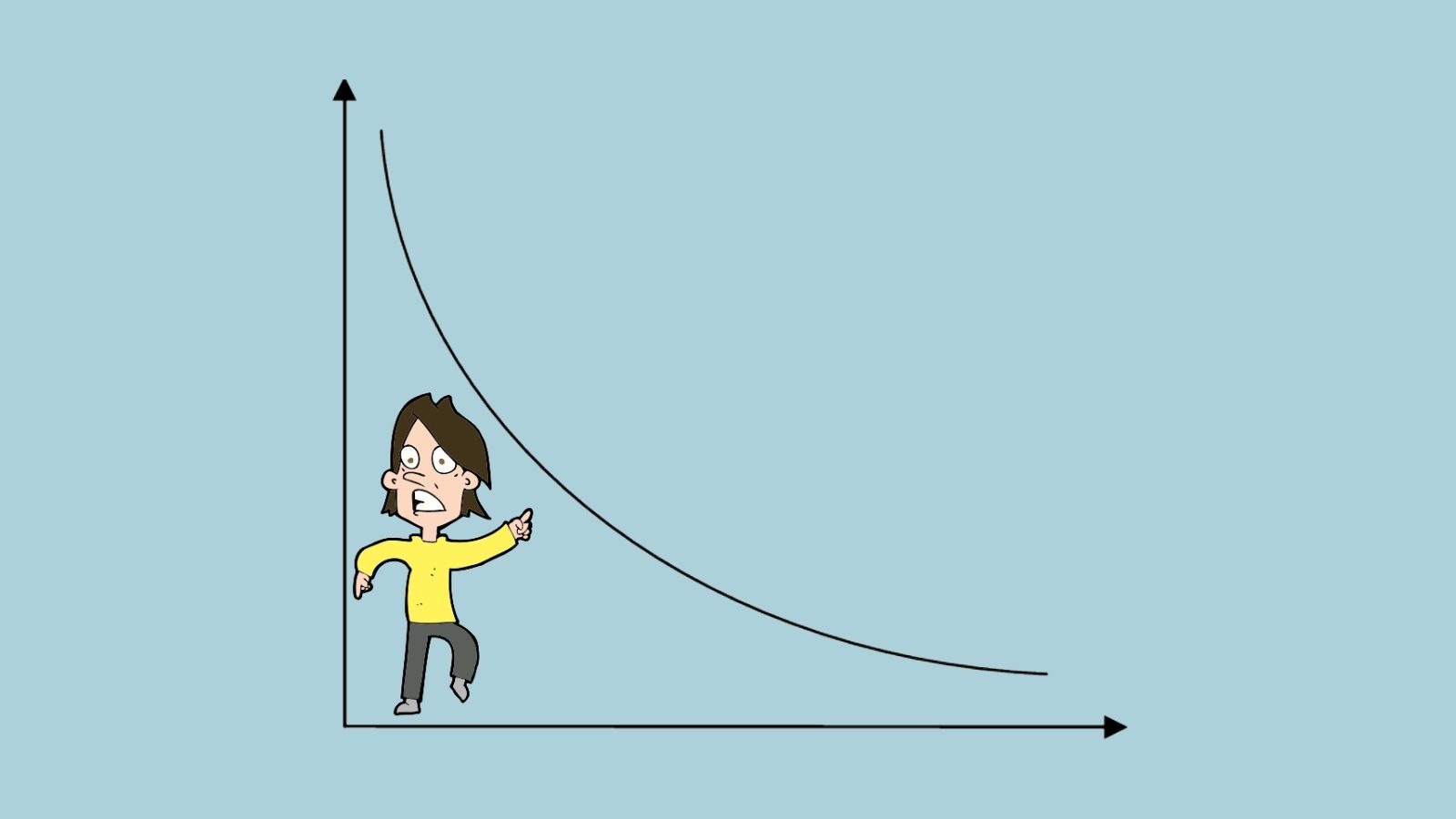

Does the Yield Curve Forecast a Recession?

Does the Yield Curve Forecast a Recession?

Jan 1, 2019

4

min read